Revision of post from several months ago.

Americans Have Been Brainwashed by the Government and Financial Institutions.

This is one more story that reveals the manipulation of the financial system by Wall Street and Washington. It also highlights the failure of the government to protect the rights of individuals from white collar crime.

Image via WikipediaThe banks and the federal government were very wise in there implementation of the onerous psychological strategy used to “lock” in place the moral burden onto American citizens that says under no circumstance is one to walk away from their debt obligation on a mortgage. The collusion of banks, government and the media tirelessly worked to place the fear of shame and chastisement on to any homeowner who dare consider strategic default or otherwise.

Image via WikipediaThe banks and the federal government were very wise in there implementation of the onerous psychological strategy used to “lock” in place the moral burden onto American citizens that says under no circumstance is one to walk away from their debt obligation on a mortgage. The collusion of banks, government and the media tirelessly worked to place the fear of shame and chastisement on to any homeowner who dare consider strategic default or otherwise.We could argue that this was in the best interest of the country but really it was just in the best interest of the banks and money lenders. Although, the system worked rather well as long as the federal and state governments were able to keep a handle on the rate of inflation.

If the money supply was kept at a reasonable level the economy would have its normal ups and downs but there would be no unreasonable appreciation or depreciation in real estate prices. The exception would be the few boom and bust areas that have had extreme pricing fluctuations over the years. The best examples would be California, Florida and the Texas gulf coast that was up and down with the boom and bust of the oil exploration.

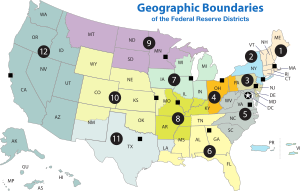

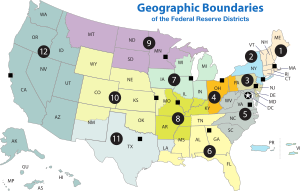

As long as we had a federal reserve that was not overly influenced by the banking system itself, it was likely that this method of economic stabilization could go on indefinitely. It would serve as a future method of taking pressure off of the “social security black box” as well as calming American’s fears of the devastation of another “great depression”. People were convinced to work hard, buy a home, pay 3 to 4 times what it was worth in interest and then recover about ½ of what they paid overall when they sold their home upon retirement.

The Banks were getting fat and the government was getting a reasonable calm and non-revolutionary population that was content with these terms. People came to believe that paying your mortgage was an honor and a privilege. Defaulting on a mortgage, unless you were in extreme distress was extremely taboo.

Over time paying down a mortgage looks reasonably good if you stayed in your home for 10 or 15 years. The ability to pay the same as you would for rent while having the boost of pride people felt as “homeowners” seemed to make this a workable arrangement even though the banks benefited far greater in terms of return than did individual owners.  Image via Wikipedia

Image via Wikipedia

Image via Wikipedia

Image via WikipediaThe banks used this manipulation to continually lower their capital requirements as both the banks and the government came to rely and the “moral and ethical” home owner. Over time, many people came to believe that increase or at least the stability in the real estate market was a normal part of the capitalist system. However, all the misleading information and manipulation lead to a false sense of security, undue pressure on families in times of crisis and extreme tolerance of risk that was taken by allowing banks to become under capitalized.

Slowly but surely the big banks and the Wall Street elite came to realize that this stable and consistent market could lead to some ridiculous wealth if it could be exploited. It would just take a few of the right players to get into office at the right time. We began to see the creation of the “greatest real estate depression” in history as we moved into the 21st century.

The banks count on people moving every 7 years. They amortize mortgages so the first seven years is nearly all interest. This is just another example of how our capitalist system has changed into pseudo capitalism. The pseudo capitalism leaves the little guy out in the cold because of the tremendous influence the bankers have on policy always leads to more favorable policy for the banks.

A number of factors would eventually lead to repeated mistakes by the Federal Reserve that would drastically increase the money supply. Interest rates were kept far too low for far too long as growth and expansion of the economy became the North Star guiding fed policy.

Image via WikipediaAfter we suffered the tragic events of September 11, 2001 our reliance on excessively low interest rates strengthened. It was more circumstance than deviance that prodded the reserve chairman to opt to keep interest rates at “hot” levels. As patriots many of us could argue little with this strategy that was one way of boosting “morale” of the country. It was as if we made a pact with the devil at times of vulnerability. Politics has over taken common sense at the Federal Reserve and within a few years the “nuclear” housing race was in full effect.

Image via WikipediaAfter we suffered the tragic events of September 11, 2001 our reliance on excessively low interest rates strengthened. It was more circumstance than deviance that prodded the reserve chairman to opt to keep interest rates at “hot” levels. As patriots many of us could argue little with this strategy that was one way of boosting “morale” of the country. It was as if we made a pact with the devil at times of vulnerability. Politics has over taken common sense at the Federal Reserve and within a few years the “nuclear” housing race was in full effect. I was extremely puzzled by the flow of money into the economy at such low interest rates. My opinion in discussions with friends was that the government had painted themselves into a corner with such low rates. It was promoting the unsustainable rise in home values. Wages and income were not keeping pace with the extremely quick rise in real estate cost.

Secondary market. (factors influencing the secondary mortgage market) (column): An article from: Mortgage Banking

No comments:

Post a Comment

your feedback and opinions welcome.