Michael Olenick: Shocking Economic Insight – Mass Foreclosures Will Drive Down Home PricesBy Michael Olenick, creator of FindtheFraud, a crowd sourced foreclosure document review system (still in alpha). You can follow him on Twitter at @michael_olenick or read his blog, Seeing Through Data

“A lie told often enough becomes the truth.” – Vladimir Lenin, adopted and reused by Joseph Goebbels

Every doctor knows the fastest way to stabilize a patient is to kill them, because there is nothing more stable than death. While that solution may be fast and inexpensive it’s also sub-optimal. Yet pundits repeatedly posit the fastest way to end the housing crisis is through mass foreclosures. In a strict sense they’re right, that will achieve stability, though so will other policies calibrated to cause less micro and macroeconomic damage .. and a lot less human suffering.

Honest economists explain their reasoning, which is that there is a need to find a market bottom. They argue that in a healthy market sellers should not compete with REO properties and buyers need not worry an oncoming glut of foreclosures will drive down the value of their house. These economists, who remain in the minority, usually preface this is a lousy solution albeit the only one they can think of.

More common are bankers and economists who paint a rosy picture at the notion of throwing millions of families to the street, and millions of homes to the market.

“Once distressed inventory comes down and all of a sudden there’s not enough homes, you’re going to have a real bounce,” said JP Morgan Chase CEO Jamie Dimon in a recent interview.

Dimon surely knows the 2010 Census reports 131.8 million residential housing units for 312.9 million people, including about 17 million empties, so I’m not sure where his housing shortage comes from.

Dimon’s bank is sitting on a powder-keg of $87.6 billion of mostly worthless second mortgages at the end of Q3, 2011, according to the FDIC, so I can see why he’s playing cheerleader for a housing renaissance. But treating people like chumps, by encouraging them to buy in this broken market, crosses the line from puerile to patronizing.

If Dimon’s bank is genuinely bullish on housing then let them show it by dramatically ratcheting up their non-GSE lending. It will be interesting to see how JPM investors react to what I’m sure will be Dimon’s forthcoming announcement that JP Morgan Chase plans to lower credit-standards, increase private mortgage lending, and retain the loans on their own balance sheet.

Every argument housing cheerleaders advance is easily debunked.

Dimon argues household formation is increasing. I argue that’s irrelevant because the new couples do not qualify for home loans. Bloomberg reports that student-loan debt is approaching a crippling $1 trillion, preventing young people from qualifying for mortgages.

Bloomberg’s story focuses on a pharmacist with $110,000 in student-loan debt and a steady job that pays $125,000 a year, but who doesn’t qualify for a mortgage. It isn’t only employed professionals: the Bloomberg article goes on to note the Federal Reserve reports the number of 29-34 year old’s who qualified for a first mortgage declined from 17 percent ten years ago to 9 percent in 2009-2010. That is, young people are forming rented households.

This meme, that it’s a great time to buy a house, is relentless.

In a Bloomberg story along the same lines, Potomac Gap Shows Court Foreclosures Delay Housing Recovery, former Fannie Mae chief economist Thomas Lawler compares Maryland and Virginia house prices to argue expedited foreclosures increase home prices.

Asking Fannie’s former chief economist his thoughts on housing is akin to asking Francesco Schettino, Captain of the domed Italian cruise ship, his thoughts on maritime safety. Let’s ignore that though and focus on Lawler’s conclusion, which the data doesn’t support.

Lawler argues that Virginia and Maryland have virtually identical characteristics, yet that house prices in VA rose .8 percent last year while MD prices fell 3.6 percent. Lawler attributes this to the fact that MD is a judicial foreclosure state — where foreclosures require court approval that move through the system slower — whereas VA is a non-judicial state, where banks can simply auction a house after a default.

I have a simpler answer: house prices in MD ran up considerably higher than those in VA during the bubble so prices in both states are now adjusting towards the mean.

Specifically, according to the FHFA’s Housing Price Index (HPI) data Maryland house prices rose 17.7% higher from Q1, 2000 to Q3, 2007, when prices in both state’s peaked. Prices in MD are still 10.8% higher than those in VA, even though, by Lawler’s reasoning, they should be the same.

If anything, the data suggests judicial foreclosure is dampening home price declines in MD, by slowing foreclosures and the drag they place on home prices.

Less foreclosure inventory in judicial foreclosure states, thanks to slower foreclosure processing, reduces supply and stabilized home prices is a simpler explanation, though it’s seldom explored. I’ll refer to it as the Linda Green House Price Stabilization theory.

Obviously, people cannot continue to live in houses they are not paying for forever. But crafting public policy to figure out how to work with these people, which has the least impact on both the economy and the families involved, requires an honest and forthright dialog that just isn’t happening.

My own home state of FL is an economic disaster zone thanks largely to foreclosures and other housing related dysfunction. I often find myself spending the evening discussing housing finance.

It is not uncommon for those current, or with paid-off houses, to launch into a harangue about their irresponsible neighbors and demand that they’re thrown to the street immediately. But when I ask these people to quantify how much they’re willing to pay to punish their neighbor the answer is always zero.

I explain there are two options. One option involves modifying their neighbors mortgage, arguably giving their neighbor a windfall but limiting their own home price decline to no more than 10-percent. The other option involves throwing their neighbor to the street, decreasing the person’s home value by more than 10-percent. Nobody has ever opted to throw their neighbor out if it will personally cost them anything.

Dimon argues “indiscriminate blame of both (economic) classes denigrates our society, destroys confidence .. and damages us.” I agree, though argue the relentless “break the borrowers bones,” theme, combined with less than honest discourse about economic reality, is more destructive than frustration-fueled barbs launched towards those like him who pocketed a $21 million paycheck last year while relying heavily on corporate welfare.

Depending on one’s understanding the 50-state Attorney General settlement is worth somewhere between about $5 and $40 billion. Let’s use the higher number: we still have about a half trillion gap to put a long-term floor on the housing market. It’s time for an honest, open, fact-based national dialog about how to make that happen.

Monday, February 20, 2012

Michael Olenick: Shocking Economic Insight – Mass Foreclosures Will Drive Down Home Prices

“Crooks on the Loose? Did Felons Get a Free Pass in the Financial Crisis? “ « naked capitalism

I have to confess I have yet to do more than sample this video, but I intend to watch it in full as soon as I have a breather. This is a video of a panel discussion at NYU Law School earlier this month at which former prosecutors Neil Barofsky and Eliot Spitzer took on party-line-defending Lanny Breuer of the Department of

Thursday, February 16, 2012

The chain of title issues could be enormous……if and only if the current laws are followed. However, it seems that there is more likely a greater push for passing new laws to clear title to property with a swoop of the pen by some politician. The years of land ownership laws and real estate property ownership law have been obliterated by the banksters and their creation of MERS and their efforts to skirt transfer taxes and to increase speed.

I have mentioned to most people that buying a property in cash still may not mean you are the actual owner unless the laws are changed. This is something that was done by the banks that has the entire system turned upside down and now the administration is trying to put the genie back in the bottle at the expense of the American people.

What amazes me is that so many people are willing to still let the banks off with a free pass when this could cause problems for nearly everyone in the entire country. Evidently the rule of law is only applied to the citizens of the country and not to the institutions or the politicians.

Wednesday, February 15, 2012

Quelle Surprise! San Francisco Assessor Finds Pervasive Fraud in Foreclosure Exam (and Paul Jackson Defends His Meal Tickets Yet Again) « naked capitalism

"So the latest report from San Francisco county should come as no surprise. From Gretchen Morgenson of the New York Times, emphasis ours:

An audit by San Francisco county officials of about 400 recent foreclosures there determined that almost all involved either legal violations or suspicious documentation, according to a report released Wednesday….Yves here. I wish Morgenson had not deemed the latter abuses as “arcane”. They are actually pretty basic to lawyers – you can’t assign rights you don’t possess or sell what you don’t own. And these are concepts that laypeople can grasp readily. Back to the article, which makes clear the state attorney general Kamala Harris, who was doing a victory lap over the mortgage settlement, had nothing to do with this probe:

The improprieties range from the basic — a failure to warn borrowers that they were in default on their loans as required by law — to the arcane. For example, transfers of many loans in the foreclosure files were made by entities that had no right to assign them and institutions took back properties in auctions even though they had not proved ownership.

read the rest by following the link below Quelle Surprise! San Francisco Assessor Finds Pervasive Fraud in Foreclosure Exam (and Paul Jackson Defends His Meal Tickets Yet Again) « naked capitalism

Credit Slips also has another article on the same story about the abuses found in San Francisco.

Here's a bombshell: the San Francisco City Assessor commissioned a serious audit of foreclosure documentation filed in the past few years. The audit examined 400 foreclosures. It found problems with 85% of them, often multiple problems. What's more, some of the problems are pretty serious as they implicate not only borrowers' rights, but the integrity of mortgage-backed securities and the property title system.

The San Francisco City Assessor's audit also serves as a benchmark for evaluating the Federal-State servicing settlement. The San Francisco City Assessor managed to accomplish in a few months what the Federal government and state Attorneys General weren't able to do in nearly a year and a half with far greater resources at their disposal: perform a credible investigation of foreclosure documentation with serious implications about the securitization process in general. That's a lot of egg on the face of Shaun Donovan, Eric Holder, Tom Miller, et al. The SF City Assessor report shows that it really wasn't so hard for a motivated party to undertake a serious investigation. And that raises the question of why the largest consumer fraud settlement in history proceeded with virtually no investigation.

U.S. Stocks Fall on Greece as Apple Erases Rally - Bloomberg

U.S. stocks fell, sending the Standard & Poor’s 500 Index lower for a second day, as concern grew that Greece was moving closer to default and the Federal Reserve said policy makers were divided on buying more assets.

Apple Inc. (AAPL) decreased 2.3 percent, reversing a 3.3 percent rally and snapping an eight-day advance. Industrial shares had the biggest decline in the S&P 500 among 10 groups as Deere & Co. tumbled 5.4 percent after lowering its 2012 U.S. farmer revenue forecast. The Dow Jones Transportation Average, a proxy for the economy, slumped 2 percent as CSX Corp. (CSX) and Union Pacific Corp. (UNP) retreated more than 2.8 percent.

U.S. Stocks Fall on Greece as Apple Erases Rally - Bloomberg

New York Creates New Foreclosure Courts to Clear Backlog Yves Smith

The following is from Naked Capitalism. the full article can be read at the link after the blurb

The article mentions the fact that a New York court requirement implemented in October 2010, that required lawyers filing for foreclosures to certify that they had taken reasonable steps to verify the accuracy of the information in the filing. That in turn lowered the bar for sanctioning lawyers who failed bogus information or documents signed by parties with no personal knowledge. That led to a near-halt of new foreclosure actions, which speaks volumes as to the accuracy of prior filings. If the problems were mere “paperwork,” you might have seen a hiatus as banks implemented new procedures, but this points to far more basic problems with the banks’ ability to prove they have the right to foreclose on loans they service.New York Creates New Foreclosure Courts to Clear Backlog naked capitalism

My skepticism relates to the banks’ intent. The assumption is that they want to foreclose and that the various complaints about foreclosure delays reflect their frustration. But this is like Bre’er Rabbit complaining about being thrown in the briar patch. Banks make money on attenuated foreclosures. Georgetown law professor Adam Levitin has written about how servicers put borrowers in a fee sweatbox. If nothing else, they continue to earn servicing fees even when a borrower is hopelessly delinquent, as well as late fees, which they finally recoup when the home is sold. So I’m not confident the banks are going to enter into these talks with an eye to modifying mortgages. As both Adam Levitin and attorney and securitization expert Tom Adams have said, servicers are not set up to do mods. It’s like a new loan underwriting and they don’t have the staff or the fee structures for that to make sense.

Nevertheless, there is one area where this effort could make a big difference, and that is in short sales. I’ve heard complaints from different states that banks won’t even respond to a short sale proposal. In LA, owners have to advertise “no short sale,” otherwise brokers won’t bring buyers to a viewing. This format will make it awfully difficult for a bank to reject a short sale offer that is in line with current market prices. So this new system will probably yield some benefit but I don’t expect it to be the remedy that its sponsors hope it will be.

Multifamily Buildings to Lead U.S. Construction Gains: Economy - Bloomberg

Construction of multifamily units will lead the U.S. building industry again this year, allowing housing to contribute to growth for the first time in seven years, according to economists Michelle Meyer and Celia Chen.

Work will begin on about 260,000 apartment buildings and townhouse developments in 2012, up 45 percent from last year and the most since 2008, according to Meyer, a senior economist at Bank of America Corp. in New York. Chen, an economist at Moody’s Analytics Inc. in West Chester, Pennsylvania, is even more optimistic, projecting a record 74 percent jump to 310,000.

Home ownership rates, which have declined to the lowest levels since 1998, may keep dropping as the foreclosure crisis turns more Americans into renters. In addition, household formation will probably accelerate as an improving economy and growing employment embolden more people to stop sharing residences and strike out on their own.

“Given the ongoing shift from owning to renting, there is increasing demand for multifamily construction,” Meyer said in an interview. “Foreclosures are transitioning people out of ownership.”

Stocks rose today as Greece approved austerity plans to secure rescue funds. The Standard & Poor’s 500 Index climbed 0.3 percent to 1,346.58 at 10:45 a.m. in New York.

In Europe today, the Confederation of British Industry said the U.K. economy will escape a recession and the recovery will gain momentum this year, avoiding the need for more quantitative easing by the Bank of England.

Japan Contracts

Japan’s economy shrank an annualized 2.3 percent in the fourth quarter, more than economists estimated, as slumping exports undermined a recovery from last year’s record earthquake, other data showed today.The projected increases in U.S. multifamily construction extend gains in that began with a 6.8 percent increase in 2010 and a 54 percent surge last year to 178,300 units, according to figures from the Commerce Department. That portion of the market reached a record-low of 108,900 units in 2009 after declining for four consecutive years.

By contrast, starts on single-family homes fell last year to 428,600, the fewest in five decades of data. Bank of America’s Meyer projects single-family construction will grow 5 percent this year.

Federal Reserve Chairman Ben S. Bernanke last week highlighted the weakness in housing as limiting the economic expansion that began in June 2009.

Bernanke’s View

“The state of the housing sector has been a key impediment to a faster recovery,” Bernanke told the annual convention of homebuilders in Orlando, Florida, on Feb. 10. “Homebuilding remains depressed in most areas,” he said. “In contrast to the situation for owner-occupied homes, rental markets around the country have strengthened somewhat. Rents have been increasing and the construction of apartment buildings has picked up.”A lack of investment in residential real estate subtracted 0.03 percentage point from economic growth last year, the smallest decline since the industry last expanded in 2005.

A report later this week may show housing starts opened the year on a positive note. Builders broke ground on 675,000 houses in January, up 2.7 percent from the prior month, according to the median forecast of economists surveyed by Bloomberg News before Commerce Department data on Feb. 16.

One reason why multifamily units may rebound faster than single-family houses is the drop in demand. The homeownership rate fell in the fourth quarter to 66 percent, according to Commerce Department data. It peaked at 69.2 percent in the second quarter of 2004 and fell to a 13-year low of 65.9 percent in the second quarter of 2011.

More Foreclosures

An increase in foreclosures may push the rate down even more. Lenders had slowed the pace of home seizures as they negotiated with attorneys general in all 50 states for more than a year over allegations of faulty and fraudulent paperwork used to repossess homes. That delayed the clearing of the market necessary to any recovery and increased demand for rental units.The rental vacancy rate fell to 9.4 percent in the last three months of 2011 from 9.8 percent in the previous three months, according to data from the Census Bureau. It reached a nine-year low of 9.2 percent from April through June of last year.

Rental payments climbed 2.5 percent in 2011, the biggest gain since 2008, Labor Department figures showed.

Apartment real estate investment trusts such as AvalonBay Communities Inc. (AVB) have profited from the turn to rentals. It’s up 235 percent since its recession low on March 2, 2009, through Feb. 10. During the same period, the Standard & Poor’s 500 Index is up 92 percent.

Strengthening Demand

“Apartments should benefit once again in 2012 from a combination of gradually improving labor market, a weak for-sale market, favorable demographics and modest levels of new supply,” Tim Naughton, chief executive officer at AvalonBay, said on a Feb. 2 earnings call. “We expect that demand will outpace supply again this year, which would propel operating performance and result in another strong year for AvalonBay.”The jobless rate dropped to 8.3 in January, the lowest level in three years, and employers in the world’s largest economy add 243,000 workers to payrolls, according to a Labor Department report this month.

The improvement will contribute to an increase in the number of households being formed, further stoking demand for rental housing, according to economists like Patrick Newport at IHS Global Insight in Lexington, Massachusetts.

“We will see a surge in household formation because of pent-up demand as people move away from their parents,” Newport said. “We will see a pickup in housing where there is a much stronger pickup in multifamily.”

IHS forecasts 1.5 million households will be formed in the 12 months through March 2013 from an estimated 972,000 in the year through March 2012.

Foreclosure Defense Nationwide - Mortgage Foreclosure Help - Free Advice

Apparently the settlement that has not actually been finalized is a big win for the banks and a no win for homeowners. This article from Foreclosure Defense Nationwide gives a few of the details as to how the home owners are actually getting shafted again. The money that will be available is already being ear marked to help fill the holes in state budgets rather than be used to help and protect homeowners. It is unbelievable what the banks have pulled off again and how they have gotten away with so much criminal activity. So much for government protection.

We have been receiving literally dozens of e-mails from homeowners inquiring as to what effect the bank settlements with various attorneys general will have on their foreclosure cases. Answer: NONE, for several reasons.

First, the Attorney General claims were just that: claims by attorneys general against the banks. Private litigants were not parties to the litigation, so they are not parties to any settlement. In fact, it has already been reported that the settlements have no effect on and do not preclude an individual pursuing legal relief against a lender.

Second, the settlements are not even finalized yet. They have to be filed in court, and once they are, the states which filed the lawsuits will be free to enact whatever procedures, processes, requirements, etc. they wish as to whether a homeowner “qualifies” for any settlement proceeds. As we all know from the loan mod scam, this process can take months or even years, and there are a million ways that a homeowner can be found to ultimately not “qualify”.

Third, and perhaps most revolting and insidious, is that several of the states have ALREADY announced that portions of the settlements will be diverted to state budgets. Specific instances include Wisconsin’s announcement that it plans to use $25.6 million of the settlement money to “plug holes in the state’s budget”, while Missouri has announced that it plans to put $40 million of the settlement money into the state’s “general fund”.

So, once again, the homeowners get nothing. In fact, it has been separately announced that because the attorney general lawsuits have been resolved that the banks will be ramping up individual foreclosures, obviously now because they will not have state governments and attorneys general examining what they do. Sad, but unfortunately true.Foreclosure Defense Nationwide - Mortgage Foreclosure Help - Free Advice

Monday, February 13, 2012

"Fraud Digest" Put an end to MERS, but damage already done

What has changed in the world of mortgage assignments since the FDIC/OCC/Treasury Consent Orders?

When is a mortgage assignment actually an Affidavit posing as a mortgage assignment?

When will all Recorders of Deeds file Declaratory Judgment actions seeking to enjoin the filing of mortgage assignments by document preparers:

1. that falsely state the employer and/or address of the preparer or signer (or that only use the MERS title when the signer is not directly employed by MERS);

2. that fail to plainly set forth the date the mortgage was assigned to the assignee; or

3. that contain language about the holder of the note, such language being extraneous to an Assignment of Mortgage.

Why are such Declaratory Judgment actions needed?

This is the new language appearing on many mortgage assignments where Deutsche Bank National Trust Company is the Trustee the Trust is the Assignee and MERS is the Assignor:

This loan was held by the Assignee prior to the Assignee filing a foreclosure action on May 21, 2008. The date of the execution of this Assignment of Mortgage by the Assignor is not reflective of the date the loan was transferred to the Assignee. The execution of this document is a ministerial act to comply with the state law as to how the transfer is to be documented and is not reflective of the transfer date itself.

(Instrument #2011383648, Official Records, Hillsborough County, Florida.)

This is signed by Srbui Muradyan who is identified as Assistant Secretary, Mortgage Electronic Registration Systems, Inc., as Nominee for WMC Mortgage Corp. This document was notarized in Ventura County, CA, on October 25, 2011.

According to a statement in the upper left-hand corner of the document, the preparer was Tanya D. Simpson, Esq., of the law firm Smith, Hiatt & Diaz, P.A., a foreclosure mill in Ft. Lauderdale, Florida.

The receiving trust is Soundview Home Loan Trust 2007-WMC1.

When was the mortgage assigned to the trust? That essential question is not addressed by the Mortgage Assignment.

The signer and preparer purport to know that the loan (note: not the mortgage - the loan - that is, the promissory note) was held by Deutsche Bank as Trustee prior to May 21, 2008.

How is a Bank of America employee competent to state when Deutsche Bank National Trust Company acquired a loan?

In reality, Srbui Muradyan works for Bank of America in California. On many other mortgage assignments, Muradyan’s name appears as the preparer and the address for Muradyan is 450 E. Boundry Street, Chapin, SC - the address of Corelogic, one of the newest and largest document preparers in the country. (See Assignment of Mortgage, Book 2011, Page 13758, Pottawattamie County, Iowa - available through a Google search.)

Muradyan’s signature is always notarized in Ventura County, CA.

These new Assignments fail to plainly set forth the date that the mortgage was assigned; the individuals signing use a MERS title, never revealing their actual employers; the address of the signers is either not provided or wrongly stated, making it that much more difficult for a homeowner in foreclosure to take a simple deposition.

The OCC Review Process is not working; banks and trusts continue to use the MERS guise to seize properties without proof of ownership. The language has become even more convoluted. Tens of thousands of MERS Mortgage Assignments continue to be filed each month throughout the country.

Attorneys General Beau Biden of Delaware, Martha Coakley of Massachusetts and Eric Schneiderman of New York have all sued MERS and a declaratory judgment and injunctive relief may be part of their overall strategy. Their actions, however, will only help the citizens of Delaware, Massachusetts and New York.

While the many Linda Greens may have retired their pens in Alpharetta, there are hundreds more taking their places, still using MERS titles, still pretending to be bank officers when they are untrained clerks working for document mills.

Another solution is legislative: the Truth in Mortgage Documents Act previously discussed in Fraud Digest.

The simplest solution is for judges everywhere to reject these misleading documents and sanction the filers.

The end of MERS is long overdue.

Saturday, February 11, 2012

Dylan Ratigan: On the Mortgage Settlement: There Is No Political Solution to a Math Problem

Dylan Ratigan has written another excellent article discussing the recent bank bailout commonly referred to as a settlement. It is clear to anyone that understand economics and the housing industry that this is another ridiculous attempt to placate the public while buying votes. How do they get away with the absurd policies and intellectual fraud that it takes to do things this stupid. It is made of politicians who lie to get elected and then lie to get re-elected as the learn to worship the campaign donated dollar. Obama has no idea what will work to solve the housing crisis and is just worried about getting more votes this fall. Most congressman and women have no idea what is happening in the economy nor what would be the only way to keep the USA from continuing its Japan like ten to twenty year recovery. Instead we have been willing to forgive the banks of any malfeasance and let crimes go unpunished. It is typical that the banking system and its players get away with crimes that would easily result in 20 or 30 year sentences to anyone other than a politician or banker. It is a clear sign that our country is not run by the people and has not been for some time. Capitalism has been replaced by the Pseudo Capitalism that is only capitalism for everyone other than banks. The banks abuse the system to the brink of failure and the tax payer is used to bail them out. The banks commit unlimited amounts of fraud and other criminal activity and the government pushes for a settlement to keep the banks from living with the results of their crimes. We are no longer able to trust the government to protect our financial interest and we certainly can't trust the banks to follow any rules that may have been created to protect the public interest. Fraud is fine if you are part of the governmental-bank complex that is running the country and dictating policy to the tune of half of all mortgages being underwater. (According to Zillow, roughly half of homeowners with a mortgage are effectively underwater)

Here is part of Dylan Ratigan's article on the settlement.

The housing market's vicious deflationary cycle demands serious policy action to match the scale of the challenge. Dropping housing values lead to foreclosures, which damage housing values, and so on and so forth. According to Zillow, roughly half of homeowners with a mortgage are effectively underwater, which means they owe more on their mortgage than their house is worth. So far, the alphabet soup laden set of programs (HAMP, HARP, Hope for Homeowners) put forward by the Bush and then Obama administration have been failures. And this is because, as the Congressional Oversight Panel noted as far back as March of 2009, the single best predictor of default risk is how much equity homeowners have in a home. Many Americans, though considered homeowners, are essentially "renters with debt" (as housing analyst Josh Rosner put it). And Amherst Securities Laurie Goodman noted that with our current housing trajectory, we can expect up to 10 million more defaulted mortgages over the next decade. These foreclosures impacts housing values, reduce consumer purchases, and costs municipalities money.

The proposals on the table to solve this problem aren't inspiring. The meager mortgage settlement deal cut via furious and dramatic negotiations is unlikely to be meaningful. This settlement is essentially a continuation of previous alphabet soup housing programs, because it would not force banks to fundamentally restructure the trillion dollar underwater mortgage problem. It will generate headlines, but it will fail to address the extent of the problem. State attorneys generals have accepted the settlement for a variety of reasons, one of the most frustrating being that they are substantially under-resourced and this deal moves cash their war. This is not how to make good policy. And the housing market will continue to suffer if our political leaders cannot acknowledge the depth of the problem.

Instead, we need some serious discussion from both the Republican candidates and the Obama administration about how to write down mortgage debt. Some proposals would reduce principal, while giving the banks an equity appreciation stake in the home. Others would deal with the problematic accounting standards which allow banks to overvalue second mortgages, and imply that one or more large banks needs to be restructured by the government. These are worth considering. We think it's important, regardless of how policy-makers reduce the debt, to force the banking system to appropriately value mortgage debt.

Read the rest by following the link below

Dylan Ratigan: On the Mortgage Settlement: There Is No Political Solution to a Math Problem

Friday, February 10, 2012

The Servicing Settlement: Banks 1, Public 0 - Credit Slips

Is this really the best our government can do? I hope not. This settlement might or might not be the end of the attempt to rectify the financial crisis, but as things stand, we have a settlement in which the banks commit to follow the law and pay out some pocket change. The settlement doesn’t fix the housing market. It doesn’t create accountability for the financial crisis. It doesn’t even create incentives against future wrong-doing. But it provides the Obama Administration (and those attorney generals who just jumped in for the settlement at the last minute) with a fig leaf of political cover. It galls me is that the Obama Administration is going to trumpet this settlement as evidence that it is serious about prosecuting the crimes behind the financial crisis and helping homeowners. It was heartening to hear Obama talk about protecting the middle class in his State of the Union address. It was the right message, but the President is simply not a credible messenger. If Obama wants to run as the champion of Main Street against Romney, the Captain of Wall Street, he’s going to need to do something a lot more credible than this settlement.

The score: Banks 1, Public 0.

Read the Full Article by clicking on the link below.

The Servicing Settlement: Banks 1, Public 0 - Credit Slips

The Subprime Shakeout

The Subprime ShakeoutToday, the Attorneys General of 49 states (with Oklahoma being the lone holdout) announced a record $26 billion settlement with the nation’s five largest servicers over false and fraudulent foreclosure practices like robosigning. That big number looks great on paper, but I’ve seen far to much during my time covering MBS developments to trust in optics alone.

As expected, when I dig into the details of this settlement, I realize that only $5 billion of the total consists of cash payments, while another $17-20 billion consists of principal write-downs and other aid to homeowners at risk of default. What this means is that, once again, regulators have allowed banks to shift penalties based on their improper servicing practices onto the bondholders that actually own the loans. As Yogi Berra famously said, “it’s like déjà vu all over again,” only this time, the regulators should known better.

To understand why, let’s flash back to 2008, the last time we saw a massive, multi-state settlement sponsored by the AGs. Back then, the target was Countrywide, and the lender was being sued from all sides by AGs over predatory lending practices. The proposed solution back then, as it has been in every regulatory effort to solve the housing crisis to date, was widespread loan modifications (this is why you’ll notice that the cover of Way Too Big to Fail features Uncle Sam futilely swinging a hammer labeled “Loan Mods” at the problems that keep popping up in a game of Mortgage Crisis Whack-a-Mole).

With great fanfare, the AGs announced in October 2008 that they had reached an $8.6 billion settlement with Countrywide, in which Countrywide would modify 400,000 loans. What I soon realized was that this would not be a cash payment of $8.6 billion — instead, most of that figure consisted of, you guessed it, principal writedowns and other loan modification “credits.” The only problem was that 88% of the mortgages that Countrywide had agreed to modify were no longer owned by Countrywide, meaning that the bulk of the costs of this settlement would be born by others.

The settlement resulted in a lawsuit by Greenwich Financial Services on behalf of unnamed bondholders that essentially said, “hey, we actually have contracts with Countrywide that say they can’t modify loans willy-nilly and take money our of our pockets without compensating us.” The lawsuit put Greenwich CEO Bill Frey in a position to be a spokesperson for aggrieved bondholders, thrusting him into the spotlight and the crosshairs of controversy. The banks’ response was to begin a massive lobbying effort that led to the passage of the Servicer Safe Harbor in 2009 – a provision that in its original form said that banks could ignore its contracts with investors in the interests of public policy. Only the Senate’s fears that such a law would run afoul of the Takings Clause of the 5th Amendment (I wrote a feature-length article on this issue), and a last-minute lobbying effort by bondholders, led to the provision being severely watered-down before it passed in its final form.

The question I asked at the time, along with several other astute commentators in the media, was whether the AGs had purposefully bailed out the banks by allowing them to pass costs onto investors, or whether they had been played by a more sophisticated counterparty. I guessed that it was the latter – the AGs simply didn’t understand that most of these loans were in securitizations, and that the banks that had originated them and still serviced them, didn’t actually own them any longer.

But, what’s their excuse now? Enough has been written about this issue in the 4 years since the last settlement, and enough trips have been taken to Washington and state capitols by bondholder advocates, that our elected officials should be reasonably knowledgeable about mortgage securitization and the transfer of ownership that took place. They should understand that the bank that services a mortgage, and has the power to reduce the principal balance or otherwise modify the mortgage, may not actually own it or bear the cost of this modification. And yet, we see the same strategy being implemented today to solve the housing crisis that was being attempted back in 2008 – yell at the banks about poor practices while bailing them out with a back-door loss shifting strategy, give the money to underwater homeowners in the form of loan mods, and ignore the fact that our pension funds, college endowments and life insurance investments are being looted in the process (note that homeowners haven’t even received the benefit of many of these bargains, as servicers have been reluctant to actually go through with loan mods due to uncertainty regarding their contractual rights to do so).

This doesn’t even get into the other 800 lb gorilla lurking in the corner of room — the $400 billion of second lien loans held by the biggest four servicers on their books. These loans are being kept at close to par on banks balance sheets despite being worth a fraction of that because they sit behind underwater first liens in priority. Though the terms of this settlement are still emerging, I would be dollars to donuts that 2nd liens are being handled as they’ve always been by regulators — they’ll be modified in pari passu or “on equal footing” with first liens, which essentially disregards their contractual standing as subordinate to first liens (that is, seconds should be wiped out if a first lien modification becomes necessary).

To someone who has been writing for four years about the dire consequences of this type of loss shifting and contract trampling — including a loss of confidence in the financial markets and the rule of law that will discourage desperately-needed private capital from returning to the mortgage market — it’s incredibly disappointing that this message has apparently fallen on deaf ears. If this crisis is to be resolved, it must be resolved in a way that honors contracts and restores investor confidence, or the housing market will never recover.

The one silver lining in this otherwise grey cloud of an announcement is the fact that the settlement does not release any claims that regulators or private parties may have surrounding the origination or securitization of mortgage loans. Thus, there remains some hope that by aggressively pursuing remedial action against the banks for the way in which they created an sold mortgage backed securities in the first place, regulators (the Mortgage Fraud Task Force, for example) could create a resolution framework that would disincentivize future fraud and irresponsible lending while sending a clear message to bondholders, insurers and homeowners that contracts and the rule of law still mean something in this country.

Based on what I’ve seen thus far, I’m not holding my breath. Returning to the always-appropriate Yogi quotes, we may have “made too many wrong mistakes,” to dig ourselves out now.

The States With the Most Homes in Foreclosure - 24/7 Wall St.

For Nevada, things aren’t going well. Its already dismal economy and housing situation are still getting worse. Nevada didn’t experience a glut of foreclosures last year because the state has a particularly lengthy foreclosure process. Between the third quarter of 2006 and the third quarter of 2011, the median home value in the state tumbled by nearly 60%. By the third quarter of this year, Fiserv-Case Shiller projects home prices will fall an additional 13.9% — by far the worst drop in the country. Nevada has the worst unemployment rate in the country, at 12.6%, and 13.4% of mortgage owners were delinquent on payments for 90 days or more last year.

Bank Settlement could be a free pass as fraud by bankers becomes acceptable

Lets get this straight and make sure I am reading this correctly.

homeowner loses home to party with no legal right to take the property

banks knowingly, in most cases, proceeded to move forward with the knowledge that they were committing fraud

And rather than go after those parties at the heart of the crisis this settlement givers those wronged homeowners a chance to possible collect 1500 to 2000 if they jump through enough hoops. I believe what I am seeing but I can't believe I am seeing in the United States of America. The government/wall street complex has taken over the country and citizens are getting shafted. In the long run will it ever be possible for the public trust in government to return? Seems like a logical question since politicians are more worried about campaign donation and getting re elected than they are about doing what is right and just in this country. Corporate criminal behavior has been sanctioned by the government. The entity that we have lived with for years that was created to protect the public interest has joined forces with the Too Big To Fail banks and hung the American People out to dry.

The administration is only trying to put on a show before the election to garner votes from those who will be lead to believe that they is in the best interest of the public. News Flash!, public gets screwed in mortgage settlement. Obama attempts to placate middle American with a milk bone.

It is still possible that there may be criminal prosecutions for the fraudulent activity that lead to the demise and then the stagnation in the housing market. However, this is one of many spin attempts to take eyes off the egregious nature of these crimes. It certainly will not make the banks look bad or take any further hits to their public imagine. It will take a little while before we see the effects of this settlement on the housing market.

Wednesday, February 8, 2012

Beau Biden, Delaware Attorney General, Sues Big Banks' Mortgage Registry

Delaware Attorney General Beau Biden sued a private national mortgage registry on Thursday, citing a slew of deceptive trade practices that prevent homeowners from effectively fighting off foreclosure.

The lawsuit in state court alleges that Mortgage Electronic Registration Systems Inc. deceived borrowers by knowingly obscuring important information, acting as an agent of the true owners of mortgage loans without authority, and failing to properly oversee the registry or enforce its own rules for foreclosure proceedings.

Major mortgage industry players -- including Bank of America, Wells Fargo, Fannie Mae and Freddie Mac -- formed MERS in 1995 to bypass county records offices and facilitate the then-booming mortgage-backed securities market. That market's collapse helped bring about the 2008 Wall Street meltdown that sparked the Great Recession.

In a statement outlining the lawsuit, Biden's office said that MERS "engaged and continues to engage in deceptive trade practices that sow confusion among homeowners, investors, and other stakeholders in the mortgage finance system, seriously damaging the integrity of the land records that are central to Delaware's real property system, and leading to improper foreclosure practices."

Homeowner confusion arose from the fact that MERS assumed title to the mortgage instruments associated with the loans that its member organizations were bundling and selling off as securities. Yet MERS, according to the complaint, failed to ensure proper transfer of the mortgages, leading it to foreclose upon houses without the authority to do so. Homeowners trying to fight off foreclosure were hampered by the convoluted chain of title -- in other words, it wasn't clear who was actually foreclosing on them.

Over the past summer, both Biden and Massachusetts Attorney General Martha Coakley announced investigations into MERS. In the wake of those announcements, MERS revised its rules to forbid its members from foreclosing on houses in the registry's name, according to a Reuters report.

DELAWARE COURT ORDERS BANK OF NEW YORK MELLON AS TRUSTEE TO FULLY COMPLY WITH COURT’S DISCOVERY ORDER UNDER THREAT OF DISMISSAL WITH PREJUDICE AND ASSESSES SANCTIONS

A Sussex County, Delaware Court has entered an Order finding that Bank of New York Mellon as Trustee of a First Horizon securitized mortgage loan trust failed to comply with the Court’s prior order compelling discovery, and has also assessed sanctions against BNYM for the the homeowner’s having to bring a Motion for Sanctions against BNYM for violation of the Court’s discovery Order. The Order also provides that if BNYM continues to not comply with the prior Order that the case will be dismissed with prejudice.

The homeowneer is represented by Jeff Barnes, Esq. and local Delaware counsel Paul G. Enterline, Esq. We believe this to be the first case in Delaware where securitization-related discovery is being compelled under the threat of a dismissal with prejudice for noncompliance with a prior discovery order. Mr. Barnes has already had several foreclosure cases dismissed in Florida and New Jersey for a foreclosing Plaintiff’s failure to comply with discovery, and he has also obtained court orders assessing attorneys’ fees against “banks” for noncompliance with discovery.

The foreclosing Plaintiff styles itself as the trustee for a series of pass-through certificates by a division of a Tennessee bank “Master Association” in its capacity as trustee under a Pooling and Servicing Agreement and assignee of MERS. As such, all issues as to the securitization including the PSA and MERS’ involvement are implicated by virtue of the Plaintiff’s self-chosen denomination.

It is common knowledge that Joseph Biden III, the Attorney General of Delaware, has sued MERS in a 91-page Verified Complaint sounding in deceptive trade practices which have lead to improper foreclosures. We expect many of the issues in the Biden lawsuit to be raised in the Sussex County litigation.

See more on Biden and the suing of MERS HERE

Tuesday, February 7, 2012

Mirabile Dictu! Missouri Attorney General Files Criminal Lawsuit on Robosiging

“Linda Greene” has become a household word to those on the foreclosure fraud beat. And it turns out, for once, that the work of diligent investigators such as the foreclosure attorneys around Max Gardner, and investigators like Lynn Szymoniak and Lisa Epstein led to press coverage which in turn spurred prosecutors to act.

What is striking about the indictment by a Missouri grand jury is that the Missouri AG Chris Koster has decided to challenge the banks’ party line that robosigning and related abuses were mere “paperwork problems.” He’s called robosiging what it is: forgery. The 136 count indictment is for forgeries and false declarations, and the targets are LPS subsidiary and its founder and past president, Lorraine Brown. From a press release by Koster:

Today’s indictment reflects our firm conviction that when you sign your name to a legal document, it matters,” Koster said. “Mass-producing fraudulent signatures on millions of real estate documents across America constitutes forgery. When you file those documents in our state, you are committing a crime under Missouri law.

The forgery and false declaration counts each allege that the person whose name appears on 68 notarized deeds of release on behalf of the lender is not the person who actually signed the paperwork. The documents were then submitted to the Boone County Recorder of Deeds as though they were genuine…

DOCX’s role in the robo-signing process came to national attention when 60 Minutes reported that Linda Green, an employee of DOCX, purportedly signed thousands of mortgage-related documents on behalf of several different banks and in multiple handwritings. The 68 documents on which the indictments are based were purportedly signed by Linda Green, but were in fact allegedly signed by someone else.

Forgery is a Class C felony and False Declaration is a Class B misdemeanor. If convicted on the most serious count, Brown could face up to seven years in prison for each count. DOCX could be fined up to $10,000 for each forgery conviction and $2,000 for each false declaration conviction.

The open question is whether Koster intends to stop here or is using the mob prosecution strategy that Catherine Cortez Masto seems to be employing, that of going after LPS, which was the major outsourcing platform for servicers, and seeing where that trail leads.

Additional comments from Gretchen Morgenson of the New York Times:

One of the largest companies that provided home foreclosure services to lenders across the nation, DocX, has been indicted on forgery charges by a Missouri grand jury — one of the few criminal actions to follow reports of widespread improprieties against homeowners…

A grand jury in Boone County, Mo., handed up an indictment Friday accusing DocX of 136 counts of forgery in the preparation of documents used to evict financially strained borrowers from their homes. Lorraine O. Brown, the company’s founder and former president, was indicted on the same charges.

Employees of DocX, a unit of Lender Processing Services of Jacksonville, Fla., executed and notarized millions of mortgage documents for big banks and loan servicers over the years. Lender Processing closed the company in April 2010, after evidence emerged of apparent forgeries in these documents, a practice now called robo-signing.

DocX was a particularly bad actor; we’ve discussed in earlier posts how it had a price sheet for various services, including fabricating documents like mortgage note out of whole cloth. I’m surprised it has taken this long for someone to go after them. While this is clearly good news for borrowers and bad news for LPS, I doubt that anyone at the banks will feel threatened by this action. Unless this action leads to further prosecutions, it only scrapes the surface of bad conduct in the mortgage arena.

Monday, February 6, 2012

ILLUSION OF RECOVERY – FEELINGS VERSUS FACTS

“There is no means of avoiding a final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as the final and total catastrophe of the currency involved.” – Ludwig von Mises

The last week has offered an amusing display of the difference between the cheerleading corporate mainstream media, lying Wall Street shills and the critical thinking analysts like Zero Hedge, Mike Shedlock, Jesse, and John Hussman. What passes for journalism at CNBC and the rest of the mainstream print and TV media is beyond laughable. Their America is all about feelings. Are we confident? Are we bullish? Are we optimistic about the future? America has turned into a giant confidence game. The governing elite spend their time spinning stories about recovery and manipulating public opinion so people will feel good and spend money. Facts are inconvenient to their storyline. The truth is for suckers. They know what is best for us and will tell us what to do and when to do it.

The false storyline last week was the dramatic surge in new jobs. This fantastic news was utilized by the six banks that account for 80% of the stock market trading to propel the NASDAQ to an eleven year high and the Dow Jones to a four year high. The compliant corporate press did their part with blaring headlines of good cheer. The entire sham was designed to make Joe the Plumber pull out one of his 15 credit cards and buy a new 72 inch 3D HDTV for this weekend’s Super Bowl. When you watch a CNBC talking head interviewing a Wall Street shyster realize you have the 1% interviewing the .01% about how great things are.

What you most certainly did not hear from the MSM is that the NASDAQ is still down 42% from its 2000 high of 5,048. None of the brain dead twits on CNBC pointed out the S&P 500 is trading at the exact same level it reached on April 8, 1999. Twelve or thirteen years of zero or negative returns are meaningless when a story needs to be sold. On Friday the hyperbole utilized by the media mouthpieces was off the charts, leading to an all-out brawl between the critical thinking blogosphere and the non-thinking “professionals” spouting the government sanctioned propaganda. Accusations flew back and forth about who was misinterpreting the data. I found it hysterical that anyone would debate the accuracy of BLS (Bureau of Lies & Swindles) data.

The drones at this government propaganda agency relentlessly massage the data until they achieve a happy ending. They use a birth/death model to create jobs out of thin air, later adjusting those phantom jobs away in a press release on a Friday night. They create new categories of Americans to pretend they aren’t really unemployed. They use more models to make adjustments for seasonality. Then they make massive one-time adjustments for the Census. Essentially, you can conclude that anything the BLS reports on a monthly basis is a wild ass guess, massaged to present the most optimistic view of the world. The government preferred unemployment rate of 8.3% is a terrible joke and the MSM dutifully spouts this drivel to a zombie-like public. If the governing elite were to report the truth, the public would realize we are in the midst of a 2nd Great Depression.

The unemployment rate during the Great Depression reached 25%. Without the BLS “adjustments” the real unemployment rate in this country is 23%. Cheerleading and packaging the data in a way to mislead the public does not change the facts:

- There are 242 million working age Americans. Only 142 million Americans are working. For the math challenged, such as CNBC analysts, that means 100 million working age Americans (41.5%) are not working. But don’t worry, the BLS says the unemployment rate is only 8.3%. Things are going so swimmingly well in this country the other 33.2% are kicking back enjoying the good life.

- The labor force participation rate and employment to population ratio are at 30 year lows. The number of Americans supposedly not in the labor force is at an all-time record of 87.9 million. A corporate MSM pundit like Steve Liesman would explain this away as the Baby Boomers beginning to retire. Great storyline, but the facts prove that old timers are so desperate for cash they have dramatically increased their participation in the labor market.

- The data being dished out by the government on a daily basis does not pass the smell test. The working age population since 2000 has grown by 30 million people. The number of people working has grown by only 4.7 million. A critical thinker would conclude the unemployment rate should be dramatically higher than the reported 8.3%. But the government falsely reports the labor force has only increased by 11.8 million in the last eleven years. They have the gall to report that 17.9 million Americans just decided to leave the workforce. The economy was booming in 2000. It sucks today. Don’t more people need jobs when times are tougher? The Boomers retiring storyline has already proven to be false. The fact that 46 million (15% of total population) people are on food stamps is a testament to the BLS lie. A look at history proves how badly the current figures reek to high heaven:

- 2000 to 2011 – Not in Labor Force increased by 17.9 million.

- 1990′s – Not in Labor Force increased by 5 million.

- 1980′s – Not in Labor Force increased by 1.7 million.

- The Not in the Labor Force category is utilized to hide how bad the employment situation in this country really is. They conclude that 17 million out of 38 million Americans between the ages of 16 and 24 are not in the labor force. That is complete bullshit. From the time I turned 16, I worked. Everyone I knew worked. I worked through high school and college. It is a lie that 45% of these people don’t want a job. If you dig into their data, you realize the horrific state of employment in this country:

- 74% of 16 to 19 year olds are not employed

- 85% of black 16 to 19 year olds are not employed

- 31% of black 25 to 54 year old men are not employed

- 40% of 20 to 24 year olds are not employed

- 22% of 25 to 29 year old males are not employed

- 22% of 50 to 54 year old males are not employed

- According to the BLS, 11% of men between 25 and 54 are not in the labor force

Until Debt Do Us Part

“Insanity is doing the same thing, over and over again, but expecting different results.” – Albert Einstein

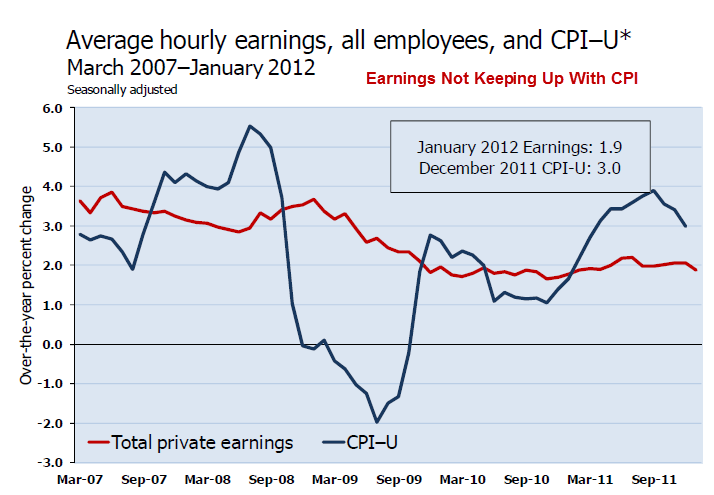

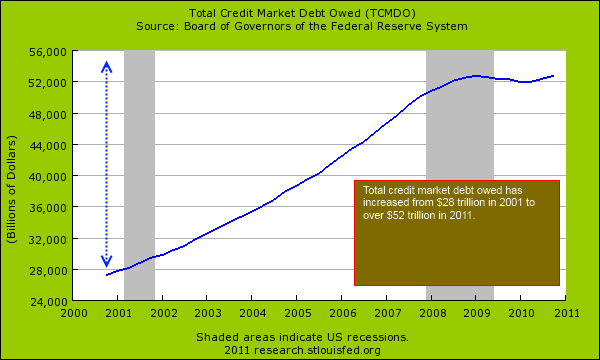

The recovery storyline being touted by the oligarchy of politicians, bankers and media is designed to make consumers feel better. This is a key part of their master plan. Any honest assessment of the financial disaster that struck in 2008 would conclude it was caused by too much debt peddled to too many people incapable of paying it back, too few banks having too much power, the Federal Reserve keeping interest rates too low for too long, and that same Federal Reserve doing too little regulating of the Too Big To Fail Wall Street mega-banks. I wonder what Albert Einstein would think about the “solutions” rolled out to fix our debt problem. Would he find it insane that total credit market debt has actually risen to an all-time high of $53.8 trillion, up $533 billion from the previous 2008 peak? Our leaders have added $6.1 trillion to our National Debt in the last four years, a mere 66% increase. This unprecedented level of borrowing certainly did not benefit the American people, as real GDP has risen by $96 billion, or 0.7%, over the last four years.

Would Einstein find it insane that the governing elite would encourage the 4 biggest banks, that were the main culprits in creating a worldwide financial collapse, to actually get bigger? The largest banks in the U.S. now control 72% of all the deposits in the country versus 68.5% in 2008. The Too Big To Fail are now Too Bigger To Fail. Rather than liquidating the bad debts, breaking up the insolvent banks, selling off the good assets to well run banks, firing the executives, and wiping out the shareholders & bondholders foolish enough to invest in these badly run casinos, the powers that be chose to protect their fellow .01% brethren and throw the 99% under the bus.

Ben Bernanke, in conjunction with Tim Geithner and his masters on Wall Street, implemented a zero interest rate policy designed to enrich the Wall Street banks, force investors into the stock market, and encourage Americans to borrow and spend like it was 2005 again. Rather than accepting that our economy has been warped for decades, with over-consumption utilizing debt as the driving force, and allowing a reset, the Federal Reserve insanely encouraging banks and consumers to do the same thing again. We do know Bernanke has stolen $450 billion of interest income going to savers and senior citizens and handed it to Jamie Dimon, Vikrim Pandit, Lloyd Blankfein and the rest of the Wall Street cabal. The “austerity is bad” storyline is pounded home on a daily basis by the politicians, corporate chieftains, Wall Street billionaires, and MSM pundits. The definition of austere is “practicing great self-denial”. Did you see the mob scenes on Black Friday? Americans are incapable of any self-denial, let alone great self-denial, and the masters of our country will not allow it to happen. One look at our GDP figures confirms the non-austerity occurring in this country. In 2007, prior to the collapse, consumer spending accounted for 69.7% of GDP. Today, consumer spending accounts for 71% of GDP, with investment accounting for 12.7% of GDP. In the good old days of 1979 prior to the epic debt bubble, when the financial industry do not run this country, consumer spending accounted for 62% of GDP and investment accounted for 19% of GDP. What an insane concept. You spend less than you make and save the difference. You then invest that money where you can get a reasonable return (.15% in a money market account is not exactly reasonable).

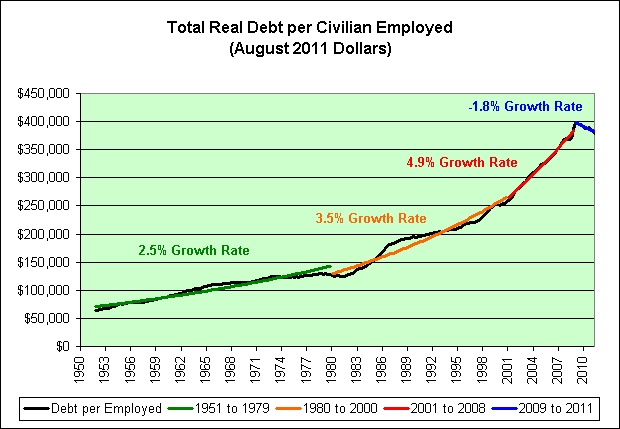

As Ludwig von Mises pointed out, a false boom created by credit expansion will ultimately collapse. We had the chance in 2008 – 2009 to voluntarily abandon the Wall Street induced credit expansion and allow our country to reset. The pain and misery would have been great, especially for the 1% who own most of the stocks, bonds and peddle the debt to the ignorant masses. As you can see in the chart below, the powers that be need debt per employed American to grow at an ever increasing rate to maintain their power and wealth. The miniscule reduction in debt from 2009 to 2011 was unacceptable. The governing powers will not be satisfied until von Mises’ final currency catastrophe is achieved.

Bernanke and his Wall Street puppet masters’ plan is actually quite simple. It’s essentially a confidence game. A confidence game (also known as a con, flim flam, gaffle, grift, hustle, scam, scheme, or swindle) is an attempt to defraud a group by gaining their confidence. The people who commit such tricks are often known as con men, con artists, or grifters. The con man often works with one or more accomplices called shills, who help manipulate the mark into accepting the con man’s plan. In a traditional confidence game, the mark is led to believe that he will be able to win money or some other prize by doing some task. The accomplices may pretend to be random strangers who have benefited from successfully performing the task. Bernanke and the 1% are the con men. They are attempting to defraud the 99% by convincing them their “solutions” will benefit them. The shills acting as accomplices are Wall Street bankers, bought off economists, politicians, journalists, and mainstream media pundits. You are the mark. The game has multiple facets but is based on more freely flowing low interest easy debt. The con man has reduced interest rates to zero at the behest of his puppet masters. The Wall Street accomplices offer enticing financing to the marks for big ticket items like automobiles, furniture and electronics. As the marks go further into debt, the Wall Street shills report record earnings ($26 billion from loan loss reserve accounting entries), consumer spending rises and GDP goes higher. The mainstream media accomplices dutifully report an improving economy. The government accomplices massage the employment and inflation data and declare a jobs recovery with no inflation. The marks are supposed to feel better about the future and spend even more borrowed money. This is what is considered a self-sustaining recovery by the psychopaths running this country.

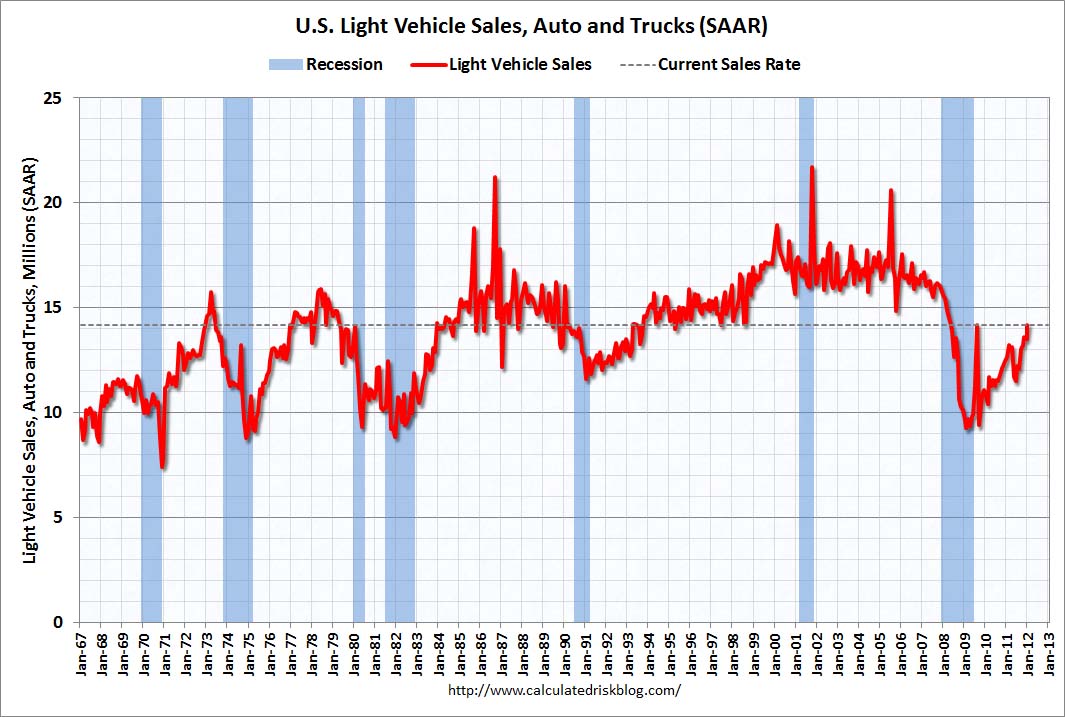

All you have to do is open your daily paper to see the confidence game in full display. Last week the MSM reported another surge in automobile sales. Our beloved American automobile manufacturers are back baby!!! Automobile sales are now pacing above 14 million on an annual basis. This is up from the depths of the recession in 2009 when the annual rate was below 10 million. We’ve breached the Cash For Clunkers level and there is nowhere to go but up. The storyline is that Obama was right to save GM and Chrysler with your tax dollars. They are now making splendid vehicles (except for the exploding Chevy Volts) and employing millions of Americans. This is a true American comeback success story. Clint Eastwood should do a commercial about it.

There is one little problem with this storyline. It’s bullshit. Remember GMAC? You bailed them out when all their subprime auto and mortgage loans went bad in 2009. They have a brand new business plan. Change your name to Ally Bank and start making as many subprime auto loans as possible. You will be happy to know that according to Experian, 45% of all auto loans being made today are to subprime borrowers. What could possibly go wrong? In addition, the average loan term has grown to almost 6 years. Executives at Ally Financial said that subprime car lending had become “very attractive” because profit margins on the loans more than cover the cost of expected losses from borrowers who fail to repay what they owe. I’m sure they have everything completely under control. Gina Proia, a company spokeswoman, said the company places “greater emphasis on the higher end of the nonprime spectrum” and only lends to people who show they can pay. I can’t believe they are restricting their loans to only people who they think can pay. I’m surprised Obama isn’t condemning them for such restrictive loan terms. If you open your paper to the auto section you will see financing offers of $0 down-payment, and 0% interest for 7 years across the board on most models. But why buy, when you can lease a luxury automobile for $300 per month? It is simply amazing how many vehicles you can “sell” when “credit challenged” Americans can rent them for seven years. I wonder if this explains why I see dozens of $40,000 luxury autos parked in front of $25,000 dilapidated hovels during my daily commute through West Philadelphia. It also seems the Big Three are “selling” a few extra vehicles to their dealers in January as pointed out by Zero Hedge. No need to let a few facts get in the way of a feel good story.

- Ford month-end inventory 86-day supply at end of Jan. (492k vehicles) vs 60-day supply (466k) as of Dec. 31

- Chrysler had 83-day supply (349k units) end of Jan. vs 64-day (326k units) as of Dec. 31

- GM month-end inventory 89-day supply (619k units) vs 67-day supply (583k) Dec. 31

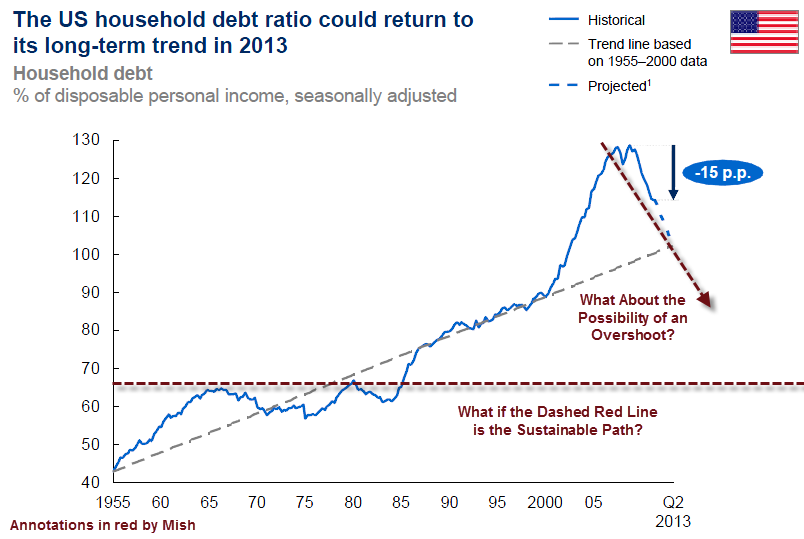

The McKinsey Group put out a report a couple weeks ago analyzing the amount of American household debt and optimistically concluding that it could be back on a sustainable path by 2013. Mike Shedlock pointed out that sustainable is in the eye of the beholder. It seems the bright fellows at McKinsey haven’t grasped the concept of regression to the mean. First of all their analysis is flawed because real disposable personal income is actually declining and Ben Bernanke’s master scam is working and Americans are now adding to their household debt. The little blue line has turned upwards since they gathered their data. Secondly, as Mish so accurately points out, the sustainable level of household debt is really at the levels prior to the debt bubble that began in the early 1980s. That is a debt level of approximately 70% of disposable personal income, as opposed to the current level of 110%.

The implications of household debt levels regressing to their long-term mean would be catastrophic to the 1%. Their kingdom of debt would come crashing down. Their power and wealth would be swept away. This is why it is so vital for them to create the illusion of recovery. Their confidence game is built upon an ever increasing flow of credit expansion. It will not work. There is no avoiding the final collapse of a boom created solely by credit expansion. Those in power will never voluntarily relinquish their grand game of pillaging the wealth of the nation, so economic collapse will be the ultimate result. They will continue to use propaganda, printing presses, and half-truths to further their agenda. But those who examine the facts will come to a logical conclusion that we are being sold a great lie.

Friday, February 3, 2012

The Permanent Foreclosure Crisis and Obama's Refinancing Obsession - Credit Slips

The Permanent Foreclosure Crisis and Obama's Refinancing Obsession - Credit Slips

The Permanent Foreclosure Crisis and Obama's Refinancing Obsession

Behind the rhetoric is an important policy choice: who will bear the billions of mortgage losses that have yet to be flushed out of the system. Principal reduction modifications for defaulted borrowers would distribute the losses among taxpayers (via Fannie and Freddie), private investors and banks (who hold non-GSE loans), and give underwater homeowners some relief. More importantly, principal modifications mitigate the aggregate losses to the system while accelerating the necessary deleveraging. Refinancing current borrowers does nothing to prevent the huge deadweight losses from continuing foreclosures, at 50% loss severities, on homes whose owners are delinquent. Choosing to do no more for the 7 million or so delinquent mortgage debtors means maximizing losses to those homeowners, but also to taxpayers and investors. It would certainly help to continue driving down home prices, which does benefit new first-time buyers, but at a huge aggregate cost.

In fact, as conservator of the nationalized Fannie Mae and Freddie Mac, the federal government could make the needed modifications of delinquent mortgages happen with a stroke of the pen, more or less. Instead, the Administration proposes the dubious strategy of loading up the FHA portfolio with 4% mortgages at 125% loan-to-value ratios, thus continuing the process of transferring future mortgage losses from banks to taxpayers, and amplifying those losses, while letting the foreclosure crisis continue, just as Mitt Romney proposes. Nothing about the refinancing strategy moves forward the process of realigning mortgage debt to home values. Instead, the strategy relies on the doubtful proposition that home values will soon return to rising at their pre-2007 clip.

Pacta sunt servanda and the housing market and broader economy be damned.

Thursday, February 2, 2012

Supreme Court Ruling Strengthens Foreclosure Mediation - KTVN Channel 2 - Reno Tahoe News Weather, Video -

Although program is good it has had its share of abuses by lawyers charging huge fees to just show up and do nothing while the bank gives another version of the paper shuffle. The teeth has come now with legislation that makes in mandatory for banks to provide the original note to the mediator and to show the have proper ownership and proper right to foreclose on the property. As you can see in the article that this is the fly in the ointment for the banks and seem to have slowed the rate of robo-signing and fraudulent paperwork dramatically.

It is hard to say it will have any lasting effect on the foreclosure problem or help increase pressure for a legitimate solution for the seriously underwater home owner but it is one step that calls for increasing accountability by the banks and servicers, something that is long over due.

Supreme Court Ruling Strengthens Foreclosure Mediation - KTVN Channel 2 - Reno Tahoe News Weather, Video -

Financial Reality Revisited Pages

- Foreclosure halt by banks was an illusion

- Learning to trade stocks in the financial reality ...

- financial reality Review of the Article by k. Galb...

- financial reality of Managing Real Estate for Prof...

- financial reality of video of hearinngs

- FRR Home

- List of housing industry related jobs from finanic...

- Listen to Financial Reality Audio Books