This is a must see video for anyone who still thinks the banks and banking system had nothing to do with the real estate melt down and current recession. It clearly identifies the causes and culprits that has cost so many honest Americans their life savings or their job.

Matt Taibbi and Your Humble Blogger on Bill Moyers « naked capitalism

Wednesday, November 28, 2012

Tuesday, November 27, 2012

Tuesday, November 20, 2012

Monitor of mortgage settlement shows banks still winning

Short Sale is option of choice for too big to fail banks and NAR.

Monitoring of the mortgage settlement with the too big to fail banks may be showing the true fraud and scam of this agreement for the people. It is full of loopholes and bank favored clauses that allow them to get away with doing virtually nothing to help homeowners stay in their homes.

The short sale has become the method of choice for the banks and for realtors across the country. It is basically giving the banks a way to clear out home owners under the veil of help. The reality is that this is a forced sale for people who would much rather have stayed in their home. The options for people forced from their home due to a short sale are very limited due the credit issues that are a result of the sale.

The NAR (National Association or Realtors) has bought heavily into the short sale option because it keeps Realtors in business and it keeps the dues coming in to pay for the ridiculous amount of lobbying that goes toward promoting the NAR agenda. It is little know that the NAR is a well oiled political machine that spends millions of dollars on lobbying each year. It is no secret that NAR is pushing some type of agenda at all times. Right now they are pushing to help the banks because they are the ones in control of the real estate. If they banks do not continue to do short sales hundreds of Realtors will be out of business and therefore will not being paying the outrageous dues each year.

Read more of the story at Naked Capitalism by following the link below:

Mortgage Settlement Monitor “Progress” Report Gooses Numbers to Hide Lack of Real Relief to Homeowners « naked capitalism

Monitoring of the mortgage settlement with the too big to fail banks may be showing the true fraud and scam of this agreement for the people. It is full of loopholes and bank favored clauses that allow them to get away with doing virtually nothing to help homeowners stay in their homes.

The short sale has become the method of choice for the banks and for realtors across the country. It is basically giving the banks a way to clear out home owners under the veil of help. The reality is that this is a forced sale for people who would much rather have stayed in their home. The options for people forced from their home due to a short sale are very limited due the credit issues that are a result of the sale.

The NAR (National Association or Realtors) has bought heavily into the short sale option because it keeps Realtors in business and it keeps the dues coming in to pay for the ridiculous amount of lobbying that goes toward promoting the NAR agenda. It is little know that the NAR is a well oiled political machine that spends millions of dollars on lobbying each year. It is no secret that NAR is pushing some type of agenda at all times. Right now they are pushing to help the banks because they are the ones in control of the real estate. If they banks do not continue to do short sales hundreds of Realtors will be out of business and therefore will not being paying the outrageous dues each year.

Read more of the story at Naked Capitalism by following the link below:

Mortgage Settlement Monitor “Progress” Report Gooses Numbers to Hide Lack of Real Relief to Homeowners « naked capitalism

Saturday, November 17, 2012

Beware of 'contract for deed' housing schemes, Mpls. officials warn | Minnesota Public Radio News

Really? Now people who are given the option to buy a home with poor credit or little money down are now victims? What does the contract for deed have to due with regulation. If someone buys a home and they become the owner, that means they get to take care of it and pay for the upkeep. This is how the Contract for Deed works in MN. You do not get title to the property until you pay off the note but you become the owner of record. It is the same as if you get a loan from the bank for your car. The bank will hold the title until you pay off the note. The you will get the note in the mail. Also in MN when you buy a home you get possession of the title while the bank places a lien on the property. Often the title can be stored with a title company or you can keep it in your own safe place. MN is a not a trust deed state.MINNEAPOLIS — Minneapolis officials and housing advocates are concerned about a trend in the housing market.

They say more property owners are striking up informal "contract for deed" deals as a way to sell homes to people who don't qualify for loans.

One more way for the city to get in the way of the housing market. The mission for years in Minneapolis and St. Paul Minnesota has seemed to be systemically remove landlords by making the costs so onerous that it no longer becomes profitable to own a rental home. I bought my first house ever on a contract for deed in Minnesota and it was a way for me to get a home while starting out in a commission job. I had not worked long enough to qualify for a bank mortgage.Some of these sellers are landlords the city says are using the arrangement to skirt safety and housing laws.

North Minneapolis resident George Williams, 48, bought his house through a contract for deed last year and said it was the best deal he could find given his shaky credit. He isn't able to get a mortgage.

"I don't qualify for it right now and I've been talk to the banks to see I even ran a check online to see if I qualify for it but I don't have any extra income coming in," Williams said.

In a contract for deed, the seller provides financing for the buyer, who makes monthly payments to the seller. Advocates say some contracts for deed, especially those provided by non-profit housing organizations, are fair.

But unlike a traditional mortgage, contracts for deed are usually just a few years long — typically three to five years. So most buyers have to refinance in order to make a balloon payment, complete the deal and get the deed to the house. But refinancing is often difficult because properties sold this way are often not appraised, so buyers may be agreeing to pay more than a home is worth. Williams is hoping to get a mortgage in time to pay his $58,000 balloon payment in three years.

"My main concern is to make sure that I am able to go to a bank and refinance on this house," Williams said.

If the buyer of the property gets their credit in order over the course of a couple of years and the property is of reasonable value they should be able to get some type of mortgage to pay of the contract for deed. Also the buyer can possible work a deal with the seller to push out the balloon payment if they need more time.

Of course there are risks associated buying a home on a contract for deed but there are risks when getting a loan from the bank. When someone it unable to qualify for a loan with a bank, the contract for deed a reasonable option. It also is a way to promote home ownership and owner occupied home ownership. This is helping the city accomplish its mission of reducing the number of landlords and increasing the number of owner occupied homes in the lower priced neighborhoods.

Read the full story:BROKER DEFENDS PRACTICE

Williams bought his home through north Minneapolis real estate broker Howie Gangestad. The broker said contracts for deed are a good way for people like Williams, who have bad credit or low incomes, to buy homes.

"There is a lot of underground society in north Minneapolis," Gangestad said. "They don't have enough income to qualify or low credit scores due to their own fault or through no fault of their own."

Gangestad charges higher interest rates than a bank. In most cases, he said that's because buyers put little to no money down. He said nobody who could get a lower interest loan would ever buy from him. "It's not a good deal for them if they can get a regular mortgage at the bank," he said. "I would never sell on a contract for deed if they qualify."

Beware of 'contract for deed' housing schemes, Mpls. officials warn | Minnesota Public Radio News

Friday, November 16, 2012

Harry Shearer: Naked Capitalism – A Beacon in the Fog of Disinformation

An interesting coupling here between Harry Shearer and Naked Capitalism. I think most anyone who has ever read Naked Capitalism can agree that it is "Beacon in the Fog of Disinformation". And for those of you who have not read this outstanding information blog, you need to get there ASAP.

For example the latest articles that are so informative have to deal with the Too Big To Fail Banks and just how much trouble we are seeing at FHA.

Harry Shearer: Naked Capitalism – A Beacon in the Fog of Disinformation

For example the latest articles that are so informative have to deal with the Too Big To Fail Banks and just how much trouble we are seeing at FHA.

Harry Shearer: Naked Capitalism – A Beacon in the Fog of Disinformation

Wednesday, November 14, 2012

Consider It Sold Las Vegas: Another Truth about Las Vegas Real Estate

Consider It Sold Las Vegas: Another Truth about Las Vegas Real Estate: Las Vegas Real Estate has people stuck in limbo now but the word is things are getting better. The reality is that 60-to 75% of homeowner...

List with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

Also follow this link for more information on

Las Vegas Real Estate

Chris LaHaie RealtorList with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

Tuesday, November 13, 2012

Petraeus CIA Scanal Amazingly kept under radar during election. Genius!

Funny how this mega scandal was held under wraps until after the 2012 election. I don't know if it would have made any difference in the outcome but it makes me suspicious of the media agenda. How could this have been so hush hush for so long during the election campaign? I have to guess that the media was in the tank for Obama again during this election as they were in 2008. I find it hard to believe that democrats are not even suspicious of the media at this point.

However, you have to admit that the political machine of the Obama administration is very good. They were able to keep this story completely out of the public eye during the campaign. It is also hard to believe that this would not have caused a major outcry regarding the recent embassy bombings. With such major scandal going on at the CIA, how could it be possible that the effectiveness of the agency was not altered in some way? I don't have the answers to this question but it is clear that we no longer live in the free country we claim. The government and banking industry have teamed up to take control of massive amounts of wealth that previously belonged middle America. Now the government has taken control of the media as well or at least formed a partnership between the democratic ruling elite and the media. How else could such a titillating story be kept from the public eye. You know any outlet would have by crazy over running this story in 2008 prior to the election. It would have been a hit against the administration but not this year. It was another free pass given to the Obama team. It is as if we have seen such drastic improvement over the past 4 years that the media decided it would team up with the government to give us 4 more years of the same. We will not see anything that will reflect poorly on the president of the next 4 years regardless of the situation. We have given the Obama administration a free 8 year pass. It is as if we have come to accept that it is impossible for change to happen in Washington. The country has opted for looking progressive over making progress. It makes little sense to the people who have suffered the most from the quasi banking/government partnership that has lead to the down fall of the American dream.

The dream now has become one of hope and change. However, it is one of false hope and little change. American has come to accept stagnation and even reversal of progress for the appearance of being the country of freedom.

The reality is that we are losing more and more of the freedoms that were fought for during the Revolution. It has nothing to do with race or prejudice and everything to do with lowered expectations and willingness to allow the country to become more and more divided between the haves and the have nots. Why? Because people fell for the spin that this President was one of the common folk. Unfortunately, this could not be farther from the truth. It has to be said he understands the media and he understands politics of being elected. His team is very good at winning elections and very good at running a campaign. No one can argue this point. However, we need to see if they are as equally qualified to run the country. For four years I have seen little evidence that the administration is as concerned about the people as it is about re-election. Maybe now that re-election is a not an issue we will see things being done for the good of the people and the good of the country.

Breaking News and Opinion on The Huffington Post

However, you have to admit that the political machine of the Obama administration is very good. They were able to keep this story completely out of the public eye during the campaign. It is also hard to believe that this would not have caused a major outcry regarding the recent embassy bombings. With such major scandal going on at the CIA, how could it be possible that the effectiveness of the agency was not altered in some way? I don't have the answers to this question but it is clear that we no longer live in the free country we claim. The government and banking industry have teamed up to take control of massive amounts of wealth that previously belonged middle America. Now the government has taken control of the media as well or at least formed a partnership between the democratic ruling elite and the media. How else could such a titillating story be kept from the public eye. You know any outlet would have by crazy over running this story in 2008 prior to the election. It would have been a hit against the administration but not this year. It was another free pass given to the Obama team. It is as if we have seen such drastic improvement over the past 4 years that the media decided it would team up with the government to give us 4 more years of the same. We will not see anything that will reflect poorly on the president of the next 4 years regardless of the situation. We have given the Obama administration a free 8 year pass. It is as if we have come to accept that it is impossible for change to happen in Washington. The country has opted for looking progressive over making progress. It makes little sense to the people who have suffered the most from the quasi banking/government partnership that has lead to the down fall of the American dream.

The dream now has become one of hope and change. However, it is one of false hope and little change. American has come to accept stagnation and even reversal of progress for the appearance of being the country of freedom.

The reality is that we are losing more and more of the freedoms that were fought for during the Revolution. It has nothing to do with race or prejudice and everything to do with lowered expectations and willingness to allow the country to become more and more divided between the haves and the have nots. Why? Because people fell for the spin that this President was one of the common folk. Unfortunately, this could not be farther from the truth. It has to be said he understands the media and he understands politics of being elected. His team is very good at winning elections and very good at running a campaign. No one can argue this point. However, we need to see if they are as equally qualified to run the country. For four years I have seen little evidence that the administration is as concerned about the people as it is about re-election. Maybe now that re-election is a not an issue we will see things being done for the good of the people and the good of the country.

Breaking News and Opinion on The Huffington Post

Monday, November 12, 2012

Regulation being wiped out story from Naked Capitalism

. Read the full story here from Naked Capitalism Blog

No matter how bad things seem to be, there are always ways for them to become worse. While the campaign against Medicare and Social Security is being couched in the sort of faux inevitability that has become familiar via European austerity measures, other pernicious lame duck session measures are moving forward in the hope no one will notice.

Dave Dayen wrote up a remarkably ugly one last Friday. Here we have just been through a wreck-the-economy level global crisis which was in large measure due to deregulation. The measure underway would not only weaken already pathetic regulators like the SEC but for good measure would hobble other ones like the Nuclear Regulatory Commission (after Fukushima, how can anyone with an ounce of sense argue for less stringent oversight of nuclear facilities?). From Dayen:

The Senate Homeland Security and Governmental Affairs Committee, under the direction of outgoing chair Joe Lieberman, plans to pass the Independent Agency Regulatory Analysis Act, S.3468, out of committee and into a fast track process. Mark Warner, Susan Collins and Rob Portman are the drives forces behind it. Americans for Financial Reform and other groups have raised alarms about it.The bill would, according to AFR, strip away independence from various regulatory agencies, including the Securities and Exchange Commission, Commodity Futures Trading Commission, OSHA, the Nuclear Regulatory Commission, the FCC and the Consumer Financial Protection Bureau. These and more agencies would have to submit additional cost-benefit analyses to the executive branch, as well as submitting their rulesand regulations for executive branch review. The immediate effect of this would be to slow implementation of things like Dodd-Frank. Review processes take time, and adding an executive branch layer gives Wall Street and other corporate interests another point of attack against various regulations. Heads of all the major regulatory agencies have already complained in a joint letter that the bill would give the executive branch far too much ability to influence their policy decisions.

Americans for Financial Reform writes:Existing cost-benefit analysis requirements, and related legal challenges, are already a major source of delay in financial rulemaking. S. 3468 would ad

at least thirteen new resource-intensive analyses of regulatory costs before a rule can be finalized. In addition, the Office of Information and Regulatory Affairs (OIRA) would get to review any significant new rule, guidance, or policy – a process could add far more time and possibly lead to new rules being abandoned altogether. OIRA has a long standing reputation for blocking environmental and safety regulations, as well as generally being sympathetic to industry arguments that regulation is excessively costly. The big banks could use their influence to turn this tiny office into a bottleneck for all financial regulation. Wall Street lobbyists would have another powerful set of tools to delay and derail the implementation of the safeguards that are needed to protect our banking system and the wider economy.AFR asks that all members of the Senate Homeland Security Committee get a phone call, to object to this gutting of the regulatory process. It’s bad enough that partisan officials get installed in these agencies, but this would just make the process of influence over the agencies complete.

Lieberman was one of the moving forces behind reducing the SEC from being a competent, even feared, agency to the mainly toothless overseer it is now. Clinton had installed Arthur Levitt, former head of American Stock Exchange, as SEC chairman; he was no doubt assumed to be friendly towards securities firms. But Levitt came out of the brokerage business and believed firmly in protecting small investors. Even with that narrow vision of the SEC’s role Lieberman, the Senator from Hedgistan, would threaten Levitt with cutting the SEC’s budget when he implemented pro-investor programs. So even though Lieberman isn’t one of the lead actors behind this measure, it is completely consistent with his history of unleashing financial firms to prey on a largely unsophisticated public.

I hope you’ll take the trouble to call or e-mail the members of the Senate Homeland Security Committee:

Sunday, November 11, 2012

Consider It Sold Las Vegas: 10 Truths about Las Vegas Real Estate

Here is an article written about the 10 truths of Las Vegas real estate. The real estate market has been in recovery according to the media and pundits. We have yet to see a real recovery starting in the south west and we may be setting things up for another bubble and crash in the next few years. a

It is hard to tell just how much the market manipulation was related to the recent election or if it just is a sign of the time. There seems to be little concern from the White House regarding the massive housing problem still dragging down the United States economy. There has been a lot of tough talk regarding actions being taken to hold those accountable for the housing meltdown but little to nothing has been done. We have been 5 years along into this recovery and the housing market is still being manipulated by the same people who brought it down in the first place.

The housing market will never be as valuable to middle America if the takeover from Wall Street is not stopped. The government has allowed the golden goose of the American economy to be taken over by Wall Street institutions and players. Until real estate is given back to little guy, our housing market will be in danger of continually running a bubble/crash cycle every few years.

Read the article linked below to find out more about the Las Vegas real estate market and the future of housing.

Consider It Sold Las Vegas: 10 Truths about Las Vegas Real Estate: I was listening to a radio show on Las Vegas real estate last night hosted by a Las Vegas real estate broker. What I heard seemed to v...

Chris LaHaie Realtor

List with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

It is hard to tell just how much the market manipulation was related to the recent election or if it just is a sign of the time. There seems to be little concern from the White House regarding the massive housing problem still dragging down the United States economy. There has been a lot of tough talk regarding actions being taken to hold those accountable for the housing meltdown but little to nothing has been done. We have been 5 years along into this recovery and the housing market is still being manipulated by the same people who brought it down in the first place.

The housing market will never be as valuable to middle America if the takeover from Wall Street is not stopped. The government has allowed the golden goose of the American economy to be taken over by Wall Street institutions and players. Until real estate is given back to little guy, our housing market will be in danger of continually running a bubble/crash cycle every few years.

Read the article linked below to find out more about the Las Vegas real estate market and the future of housing.

Consider It Sold Las Vegas: 10 Truths about Las Vegas Real Estate: I was listening to a radio show on Las Vegas real estate last night hosted by a Las Vegas real estate broker. What I heard seemed to v...

Chris LaHaie Realtor

List with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

Tuesday, November 6, 2012

Consider It Sold Las Vegas: Will Election change Las Vegas Housing Crisis and ...

Consider It Sold Las Vegas: Will Election change Las Vegas Housing Crisis and ...: The 2012 Presidential election seems to be one of the most anticipated elections in years. The early voting seems to have drawn high numbe...

Chris LaHaie Realtor

List with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

Chris LaHaie Realtor

List with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

Consider It Sold Las Vegas: Las Vegas Real Estate is unique

Consider It Sold Las Vegas: Las Vegas Real Estate is unique: Las Vegas real estate is very unique with its abundance of relatively new housing that that is nearly all in gated communities with strict...

Chris LaHaie Realtor

List with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

Chris LaHaie Realtor

List with Chris

Prudential Americana Group,

Las Vegas, NV

chrislahaierealestate@gmail.com

Sunday, November 4, 2012

The False Dodd Frank Narrative on Bank Profits (No, Honey, Obama Did Not Shrink the Banks) « naked capitalism

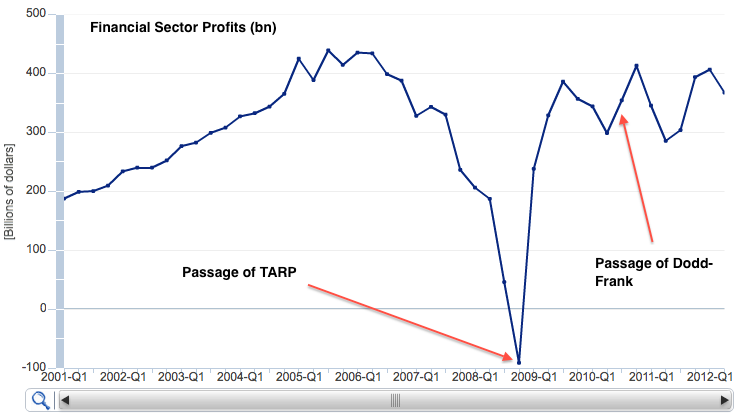

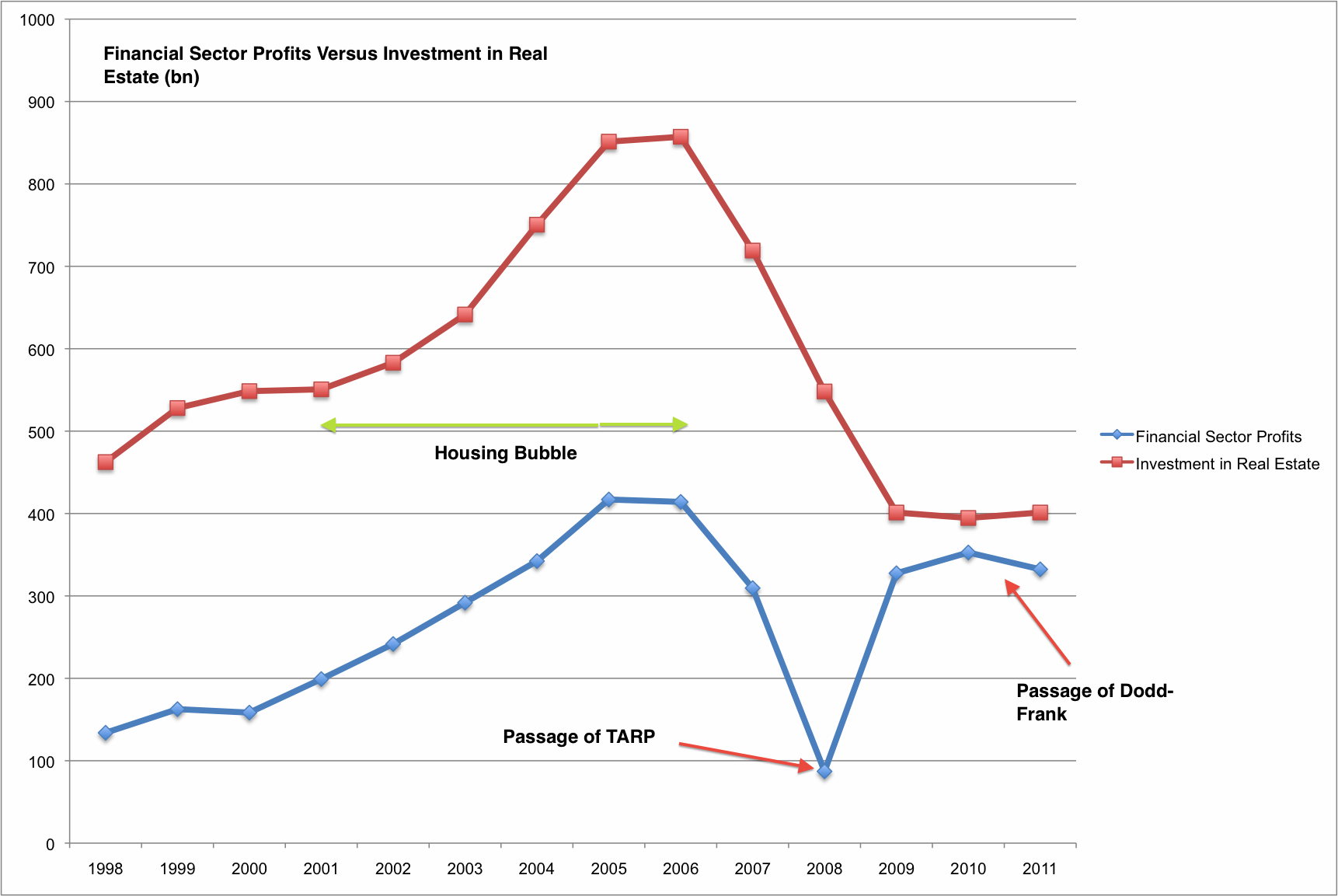

Here is another very interesting article from Naked Capitalism. It explores the ideas relating to new regulation and Wall Street Profits. It appears that the banks fortunes were saved by Tarp and that new regulation has not much of an effect on profits. However, we are hearing stories from both sides of the aisle before the election. It is clear that the banks are doing well and making money and there is no correlation between Dodd Frank and a reduction in bank profit. Even if the Obama administration would like to take credit for doing the American people justice, it really doesn't appear that anything has changed much at all. The banks seem to be profiting nicely and they seem to still be in control of the fate of the country. Banks will again cause another meltdown at some point if lessons are not learned from the current crisis. So far it doesn't look like anyone in Washington DC wants to clean up the system and keep the banks for causing another meltdown. Here is part of the article and a link for the full piece.

Isn’t the Volcker Rule making a difference? It’s hard to say, since rules are still being duked out, and we are strongly of the suspicion that, as before prop desks were spun out as separate activities, that banks will still be able to do a lot of positioning on customer desks. But the opportunities for prop trading profits parallel those for hedge funds, and hedgies have had a lousy last two years, again strongly indicating that it is hard to blame Wall Street’s fading fortunes largely or even meaningfully on new regulations.

Look, for instance, at this earnings recap from October last year (post Dodd Frank) as an illustration:

The broader picture of the financial services industry similarly does not paint the picture that the Democrats would like you to believe, that the passage of Dodd Frank has been the driver of Wall Street’s fallen fortunes. Via e-mail from Matt Stoller:

Source: BEA

His comment:

This chart reveals that financial sector profits are actually still at 2004 bubble levels, and that the profit increases and declines are correlated with the bubble and TARP, not Dodd-Frank.

Now let’s go the other part of the Tett narrative, which as someone who has been in and around the industry since 1980 I find truly peculiar. While the aggregate figures from her article, cited below, are accurate (and Simon Johnson has invoked similar statistics regarding the financialization of the economy), it leaves the reader with the misleading picture that the financial services industry, particularly the highly paid end that has been a magnet to the “best and brightest,” has had a linear march upwards from the the late 1970s-early 1980s to now:

Take a look, for example, at some research conducted by a New York based economist, Thomas Philippon, partly in association with Ariell Reshef of the University of Virginia. They chart the fluctuations of American finance since 1880 and show, firstly, how dramatically finance swelled from the late 1970s to today. Jobs in banking multiplied and the financial sector, adjusted for defence spending, rose from 4 per cent of gross domestic product to just under 9 per cent at the peak. Banker pay swelled too: although average banking salaries relative to non-banking professional salaries were almost at parity in the 1950s, by 2007 they were 1.7 times higher.

This masks serious, wrenching downturns in investment banking businesses, meaning the highly paid debt and equity origination/distribution/trading businesses, which traditional commercial banks, by dint of well over a decade of effort, finally colonized. When I joined Goldman in 1981, the firm was not enjoying great earnings and was still shell-shocked from the one-two punch of the major equity bear market of 1973-1974 and the deregulation of commissions. Wall Street was similarly hard-hit by the combo of the end of the stock bull market and takeover boom of the 1980s. First Boston effectively failed in 1988 and was merged into Credit Suisse, which was a not recognized de facto end of Glass Steagall, since this was the merger of a bulge bracket investment bank with a full fledged commercial bank. Employment in M&A, which had been one of the major profit drivers of the previous decade, fell by 75% in 1990-1991. This was also the time when the S&L crisis was ravaging major banks (Citi received its equity infusion from Prince Al Waleed in 1991). In 1994, an unexpected increase in interest rates sent shock waves across Wall Street (necessitating among other things a back door bailout of firms unduly exposed to Mexico, courtesy Robert Rubin raiding the Treasury’s Exchange Stabilization Fund). The resulting derivative losses destroyed more value than the 1987 crash. One of the casualties was Goldman:

But in 1994, substantial investment and trading losses, along with Friedman’s departure (Rubin had left in 1992),precipitated the loss of about 45 partners and their capital. Jon Corzine was elevated from head of fixed income to senior partner and named the head of investment banking, Henry M. (Hank) Paulson, as president. Corzine and Paulson immediately reduced employee headcount and costs by slashing pay and bonuses, stabilizing the firm by the end of 1995. They also put restrictions on the withdrawal of partners’ capital, and replaced Goldman’s traditional partnership structure of unlimited liability with one that named the firm as general partner and named individual partners and equity holders as limited partners.

There is also a key difference between that past, smaller S&L bubble unwind and aftermath: Alan Greenspan engineered a very steep yield curve, which allowed both commercial and investments to earn easy and comparatively low risk “borrow short-lend long” profits. By contrast, the severity of this financial crisis has led the Fed not only to drop short term rates to unheard of low levels, but to flatten the yield curve (via Operation Twist and the purchase of mortgage bonds). While that flattered financial firm balance short term by supporting asset values, it also undermined a lot of low risk traditional income sources (for commercial banks, also simply using customer “float” or money in transit, which can be deployed profitably on a short term basis when interest rates are not in ZIRP land).

Look at what has happened in areas that have not felt the hand of Basel III or Dodd Frank. M&A again is the poster child. Consider this gallows humor from the FT’s Lex column in late September:

Hooray! So far 2012 has been dismal for mergers and acquisitions. According to Mergermarket, activity in the first nine months is 20 per cent below the same period in 2011.

How about private label mortgage backed securitizations? That was a huge profit engine in the bubble just passed, and it is making zip in the way of profit contribution now. There was all of one deal in 2011. The reason, sports fans, is not reregulation, but the lack thereof. As we’ve recounted at some length in this blog, investors were badly burned by the pre-crisis abuses, and they aren’t getting back into the pool ex serious protections, which simply have not been implemented (or enough newbies finally taking the helm at investment firms that memories will have faded, but that will take at least a few years).And 2011 was not at all a good year either.

Isn’t the Volcker Rule making a difference? It’s hard to say, since rules are still being duked out, and we are strongly of the suspicion that, as before prop desks were spun out as separate activities, that banks will still be able to do a lot of positioning on customer desks. But the opportunities for prop trading profits parallel those for hedge funds, and hedgies have had a lousy last two years, again strongly indicating that it is hard to blame Wall Street’s fading fortunes largely or even meaningfully on new regulations.

Look, for instance, at this earnings recap from October last year (post Dodd Frank) as an illustration:

Goldman Sachs, weighed down by problems in its private equity portfolio and the broader global economic woes, reported a loss of $428 million, compared with a $1.7 billion profit a year ago.None of the causes cited has squat to do with regulations. And we have not even gotten to other factors, such as how the rise of HFT has led retail investors, a good source of bread and butter profits, to withdraw from trading.

It’s only the second quarterly loss for Goldman since the investment bank went public in 1999.

The company reported a loss of 84 cents a share, worse than analysts’ predictions of a loss of 16 cents, according to Thomson Reuters.

The troubles, which follow similar weakness in the second quarter, underscore the difficult environment for investment banks. Goldman, widely considered the savviest trading firm on Wall Street, had a significant revenue drop in crucial divisions like fixed income and investment banking amid the market turmoil.

The firm got whacked by negative net revenue of $2.48 billion in the investing and lending group. The results included a $1.05 billion hit on its private equity investment in the Industrial and Commercial Bank of China, a strategic investment made in 2006; I.C.B.C. stock fell roughly 35 percent in the quarter. The firm also booked net losses of roughly $1 billion related to equities, on top of net losses $907 million in debt positions.

“Our results were significantly impacted by the environment, and we were disappointed to record a loss in the quarter,” Lloyd C. Blankfein, Goldman’s chief executive, said in a statement.

The broader picture of the financial services industry similarly does not paint the picture that the Democrats would like you to believe, that the passage of Dodd Frank has been the driver of Wall Street’s fallen fortunes. Via e-mail from Matt Stoller:

Source: BEA

His comment:

TARP (which is really shorthand for the bailouts, it means TARP and HERA, which is the bill that bailed out Fannie and Freddie, which was passed at roughly the same time) is correlated with a spike in financial profits. Dodd-Frank is correlated with… nothing.Stoller’s second analysis shows the strong correlation of financial services earnings with the housing bubble (click to enlarge):

This chart reveals that financial sector profits are actually still at 2004 bubble levels, and that the profit increases and declines are correlated with the bubble and TARP, not Dodd-Frank.

This is a major topic, and we’ll be returning to it, but there is one big takeaway: in trying to bolster the case for Obama, Democrats are unwittingly carrying the financial services industry’s water in blaming new regulations for their crappy profits, when the direct consequences of the crisis they created is far and away the biggest culprit.

Read more at

The False Dodd Frank Narrative on Bank Profits (No, Honey, Obama Did Not Shrink the Banks) « naked capitalismFriday, November 2, 2012

Thursday, November 1, 2012

Consider It Sold Las Vegas: Another Real Estate meltdown for Las Vegas?

Consider It Sold Las Vegas: Another Real Estate meltdown for Las Vegas?: Is there a Real Estate Recovery in Las Vegas or are we just seeing a last ditch effort by politicians and the media to buy votes? Yes Las ...

Few housing solutions offered in presidential race - CBS News

It is quite remarkable that no one expects the housing crisis to be addressed in the presidential campaign. It is clear that the banks have gotten over on everyone with the real estate companies jumping on board to side with the banks. I am sure we will see a different tune in Las Vegas after people are held accountable and are taxed for the amount of debt relief they get with a short sale or foreclosure. Currently the Las Vegas market is seeing short sales as the preferred method of sale and with 60% of the home owners underwater ( according to the article linked below) what else could be expected? It is as if we are living in bubble that has little to do with reality. It is as if the politicians are trying to ignore the issue because they know the banks and the self righteous can sway the election.

It is clear the housing crisis in Nevada is no where near being over and will not be for several years. The short sale will not be the saving grace as it will only continue to burden the economy as people are taxed on the forgiven debt. If they are not taxed it will be because they are insolvent and likely incapable of buying another home. It may even prove difficult for many short sellers to find quality rental space.

In an attempt to be positive we can hope that much of they housing back log owned by the banks and by Fannie Mae is being cleared from the market by massive purchases from private investment firms (as we see happening in Florida) . This could possible speed up the process of market clearing and start to move the market toward equilibrium as well as transfer more and more of the country's wealth to the elites. Rather than let the banks fail, as should have been the case, and let private investors take over, they government has chosen to prop up the banks with taxpayer funds and feed sweet deals on real estate to massive equity firms. If the banks would have been allowed to fail and be taken over by private investors we would have seen far more measures taken to reduce mortgage debt and keep homeowners in their property. We would have seen recovery long ago and the market would be on the upswing again even in Las Vegas.

But of course politicians and elitists alike are so attached to the banks and big money there was no way we would see the major banks fail. Bear Sterns was used at the excuse to keep dying banks alive. It was all smoke and mirrors and we have seen nothing but the rich getting richer and taking over more and more of the country's capital. The average American has been wiped out and in Las Vegas people are going to be suffering for many more years. The housing will never get back to the levels we saw in 2006 but banks are free to go about their business and leaving the home owner to hold the bag.

Banks were rescued and banks have killed the economy. All the government programs that were to help the homeowner helped virtually one. The only beneficiary has been the banking institutions and those on Wall Street. It has been criminal but there is no accountability. Laws put into place in Nevada were meant to help homeowners have only served to prolong the housing meltdown. It is now a war of attrition with home owners and citizens of the state losing out because the banks have deeper pockets. The banks are going about business as usual pretending they are abiding by new rules and pretending they are doing something to help the recovery. The truth is that banks are not doing a thing to help the recovery and they are actually delaying the recovery. The float just enough propaganda to get stories out about a few people that have been given sweet deals so other people will hope and wait. They get people to jump through hoops over and over again in the hopes that the exasperated homeowner will finally just have to give up and move on. This again is a win for the banks. It is of course a loss for the economy and a loss for the neighborhood.

It is clear that no one really gave a dam about finding a solution the housing crisis because where the money goes so goes the power. No politician when facing re election will ever step on the toes of the banks. They will spin everything they can to give the impression they are on the side of the people but they will conspire in private to keep the money in their hands. It is clear we have become a state run by big money. Follow the money and you will see the undeniable ties between the governments and Wall Street. The system survives because people have been brainwashed into believing middle class, now lower middle class, something to be hailed as wonderful. People are willing to accept wages which will not pay for normal living standards so billions and even trillions can be paid for government election campaigns and CEO bonuses. How could it be structured that the executives of failing companies (ex. Citibank) have their CEO paid hundreds of millions of dollars?

I can see the entire system is based on corporate and state/government bedfellows. Even the real estate companies and the NAR (National Association of Realtors) are buying into the government/banking rhetoric. We see that the propaganda from them all could be produce for each other because they all repeat the same things. They want everyone to be satisfied with high unemployment, a short sale, and a tax break, even though it means moving to an apartment and having no savings left for retirement.

We have lost sight of why our country was founded in the first place and we have become exactly what we were dead set against. The Revolution is such a distant memory but I am sure those who were willing to fight and die to be free from the Queen would abhor our current situation.

Few housing solutions offered in presidential race - CBS News

It is clear the housing crisis in Nevada is no where near being over and will not be for several years. The short sale will not be the saving grace as it will only continue to burden the economy as people are taxed on the forgiven debt. If they are not taxed it will be because they are insolvent and likely incapable of buying another home. It may even prove difficult for many short sellers to find quality rental space.

In an attempt to be positive we can hope that much of they housing back log owned by the banks and by Fannie Mae is being cleared from the market by massive purchases from private investment firms (as we see happening in Florida) . This could possible speed up the process of market clearing and start to move the market toward equilibrium as well as transfer more and more of the country's wealth to the elites. Rather than let the banks fail, as should have been the case, and let private investors take over, they government has chosen to prop up the banks with taxpayer funds and feed sweet deals on real estate to massive equity firms. If the banks would have been allowed to fail and be taken over by private investors we would have seen far more measures taken to reduce mortgage debt and keep homeowners in their property. We would have seen recovery long ago and the market would be on the upswing again even in Las Vegas.

But of course politicians and elitists alike are so attached to the banks and big money there was no way we would see the major banks fail. Bear Sterns was used at the excuse to keep dying banks alive. It was all smoke and mirrors and we have seen nothing but the rich getting richer and taking over more and more of the country's capital. The average American has been wiped out and in Las Vegas people are going to be suffering for many more years. The housing will never get back to the levels we saw in 2006 but banks are free to go about their business and leaving the home owner to hold the bag.

Banks were rescued and banks have killed the economy. All the government programs that were to help the homeowner helped virtually one. The only beneficiary has been the banking institutions and those on Wall Street. It has been criminal but there is no accountability. Laws put into place in Nevada were meant to help homeowners have only served to prolong the housing meltdown. It is now a war of attrition with home owners and citizens of the state losing out because the banks have deeper pockets. The banks are going about business as usual pretending they are abiding by new rules and pretending they are doing something to help the recovery. The truth is that banks are not doing a thing to help the recovery and they are actually delaying the recovery. The float just enough propaganda to get stories out about a few people that have been given sweet deals so other people will hope and wait. They get people to jump through hoops over and over again in the hopes that the exasperated homeowner will finally just have to give up and move on. This again is a win for the banks. It is of course a loss for the economy and a loss for the neighborhood.

It is clear that no one really gave a dam about finding a solution the housing crisis because where the money goes so goes the power. No politician when facing re election will ever step on the toes of the banks. They will spin everything they can to give the impression they are on the side of the people but they will conspire in private to keep the money in their hands. It is clear we have become a state run by big money. Follow the money and you will see the undeniable ties between the governments and Wall Street. The system survives because people have been brainwashed into believing middle class, now lower middle class, something to be hailed as wonderful. People are willing to accept wages which will not pay for normal living standards so billions and even trillions can be paid for government election campaigns and CEO bonuses. How could it be structured that the executives of failing companies (ex. Citibank) have their CEO paid hundreds of millions of dollars?

I can see the entire system is based on corporate and state/government bedfellows. Even the real estate companies and the NAR (National Association of Realtors) are buying into the government/banking rhetoric. We see that the propaganda from them all could be produce for each other because they all repeat the same things. They want everyone to be satisfied with high unemployment, a short sale, and a tax break, even though it means moving to an apartment and having no savings left for retirement.

We have lost sight of why our country was founded in the first place and we have become exactly what we were dead set against. The Revolution is such a distant memory but I am sure those who were willing to fight and die to be free from the Queen would abhor our current situation.

Few housing solutions offered in presidential race - CBS News

Subscribe to:

Posts (Atom)

Financial Reality Revisited Pages

- Foreclosure halt by banks was an illusion

- Learning to trade stocks in the financial reality ...

- financial reality Review of the Article by k. Galb...

- financial reality of Managing Real Estate for Prof...

- financial reality of video of hearinngs

- FRR Home

- List of housing industry related jobs from finanic...

- Listen to Financial Reality Audio Books