Now let’s go the other part of the Tett narrative, which as someone who has been in and around the industry since 1980 I find truly peculiar. While the aggregate figures from her article, cited below, are accurate (and Simon Johnson has invoked similar statistics regarding the financialization of the economy), it leaves the reader with the misleading picture that the financial services industry, particularly the highly paid end that has been a magnet to the “best and brightest,” has had a linear march upwards from the the late 1970s-early 1980s to now:

Take a look, for example, at some research conducted by a New York based economist, Thomas Philippon, partly in association with Ariell Reshef of the University of Virginia. They chart the fluctuations of American finance since 1880 and show, firstly, how dramatically finance swelled from the late 1970s to today. Jobs in banking multiplied and the financial sector, adjusted for defence spending, rose from 4 per cent of gross domestic product to just under 9 per cent at the peak. Banker pay swelled too: although average banking salaries relative to non-banking professional salaries were almost at parity in the 1950s, by 2007 they were 1.7 times higher.

This masks serious, wrenching downturns in investment banking businesses, meaning the highly paid debt and equity origination/distribution/trading businesses, which traditional commercial banks, by dint of well over a decade of effort, finally colonized. When I joined Goldman in 1981, the firm was not enjoying great earnings and was still shell-shocked from the one-two punch of the major equity bear market of 1973-1974 and the deregulation of commissions. Wall Street was similarly hard-hit by the combo of the end of the stock bull market and takeover boom of the 1980s. First Boston effectively failed in 1988 and was merged into Credit Suisse, which was a not recognized de facto end of Glass Steagall, since this was the merger of a bulge bracket investment bank with a full fledged commercial bank. Employment in M&A, which had been one of the major profit drivers of the previous decade, fell by 75% in 1990-1991. This was also the time when the S&L crisis was ravaging major banks (Citi received its equity infusion from Prince Al Waleed in 1991). In 1994, an unexpected increase in interest rates sent shock waves across Wall Street (necessitating among other things a back door bailout of firms unduly exposed to Mexico, courtesy Robert Rubin raiding the Treasury’s Exchange Stabilization Fund). The resulting derivative losses destroyed more value than the 1987 crash. One of the casualties was Goldman:

But in 1994, substantial investment and trading losses, along with Friedman’s departure (Rubin had left in 1992),precipitated the loss of about 45 partners and their capital. Jon Corzine was elevated from head of fixed income to senior partner and named the head of investment banking, Henry M. (Hank) Paulson, as president. Corzine and Paulson immediately reduced employee headcount and costs by slashing pay and bonuses, stabilizing the firm by the end of 1995. They also put restrictions on the withdrawal of partners’ capital, and replaced Goldman’s traditional partnership structure of unlimited liability with one that named the firm as general partner and named individual partners and equity holders as limited partners.

There is also a key difference between that past, smaller S&L bubble unwind and aftermath: Alan Greenspan engineered a very steep yield curve, which allowed both commercial and investments to earn easy and comparatively low risk “borrow short-lend long” profits. By contrast, the severity of this financial crisis has led the Fed not only to drop short term rates to unheard of low levels, but to flatten the yield curve (via Operation Twist and the purchase of mortgage bonds). While that flattered financial firm balance short term by supporting asset values, it also undermined a lot of low risk traditional income sources (for commercial banks, also simply using customer “float” or money in transit, which can be deployed profitably on a short term basis when interest rates are not in ZIRP land).

Look at what has happened in areas that have not felt the hand of Basel III or Dodd Frank. M&A again is the poster child. Consider this gallows humor from the FT’s Lex column in late September:

Hooray! So far 2012 has been dismal for mergers and acquisitions. According to Mergermarket, activity in the first nine months is 20 per cent below the same period in 2011.

How about private label mortgage backed securitizations? That was a huge profit engine in the bubble just passed, and it is making zip in the way of profit contribution now. There was all of one deal in 2011. The reason, sports fans, is not reregulation, but the lack thereof. As we’ve recounted at some length in this blog, investors were badly burned by the pre-crisis abuses, and they aren’t getting back into the pool ex serious protections, which simply have not been implemented (or enough newbies finally taking the helm at investment firms that memories will have faded, but that will take at least a few years).And 2011 was not at all a good year either.

Isn’t the Volcker Rule making a difference? It’s hard to say, since rules are still being duked out, and we are strongly of the suspicion that, as before prop desks were spun out as separate activities, that banks will still be able to do a lot of positioning on customer desks. But the opportunities for prop trading profits parallel those for hedge funds, and hedgies have had a lousy last two years, again strongly indicating that it is hard to blame Wall Street’s fading fortunes largely or even meaningfully on new regulations.

Look, for instance, at this earnings recap from October last year (post Dodd Frank) as an illustration:

Goldman Sachs, weighed down by problems in its private equity portfolio and the broader global economic woes, reported a loss of $428 million, compared with a $1.7 billion profit a year ago.None of the causes cited has squat to do with regulations. And we have not even gotten to other factors, such as how the rise of HFT has led retail investors, a good source of bread and butter profits, to withdraw from trading.

It’s only the second quarterly loss for Goldman since the investment bank went public in 1999.

The company reported a loss of 84 cents a share, worse than analysts’ predictions of a loss of 16 cents, according to Thomson Reuters.

The troubles, which follow similar weakness in the second quarter, underscore the difficult environment for investment banks. Goldman, widely considered the savviest trading firm on Wall Street, had a significant revenue drop in crucial divisions like fixed income and investment banking amid the market turmoil.

The firm got whacked by negative net revenue of $2.48 billion in the investing and lending group. The results included a $1.05 billion hit on its private equity investment in the Industrial and Commercial Bank of China, a strategic investment made in 2006; I.C.B.C. stock fell roughly 35 percent in the quarter. The firm also booked net losses of roughly $1 billion related to equities, on top of net losses $907 million in debt positions.

“Our results were significantly impacted by the environment, and we were disappointed to record a loss in the quarter,” Lloyd C. Blankfein, Goldman’s chief executive, said in a statement.

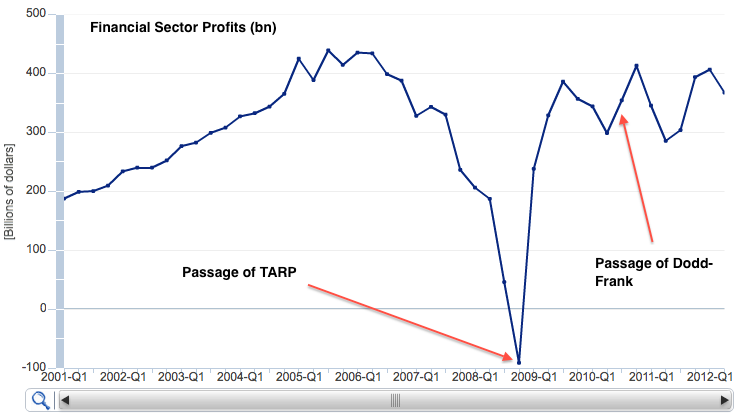

The broader picture of the financial services industry similarly does not paint the picture that the Democrats would like you to believe, that the passage of Dodd Frank has been the driver of Wall Street’s fallen fortunes. Via e-mail from Matt Stoller:

Source: BEA

His comment:

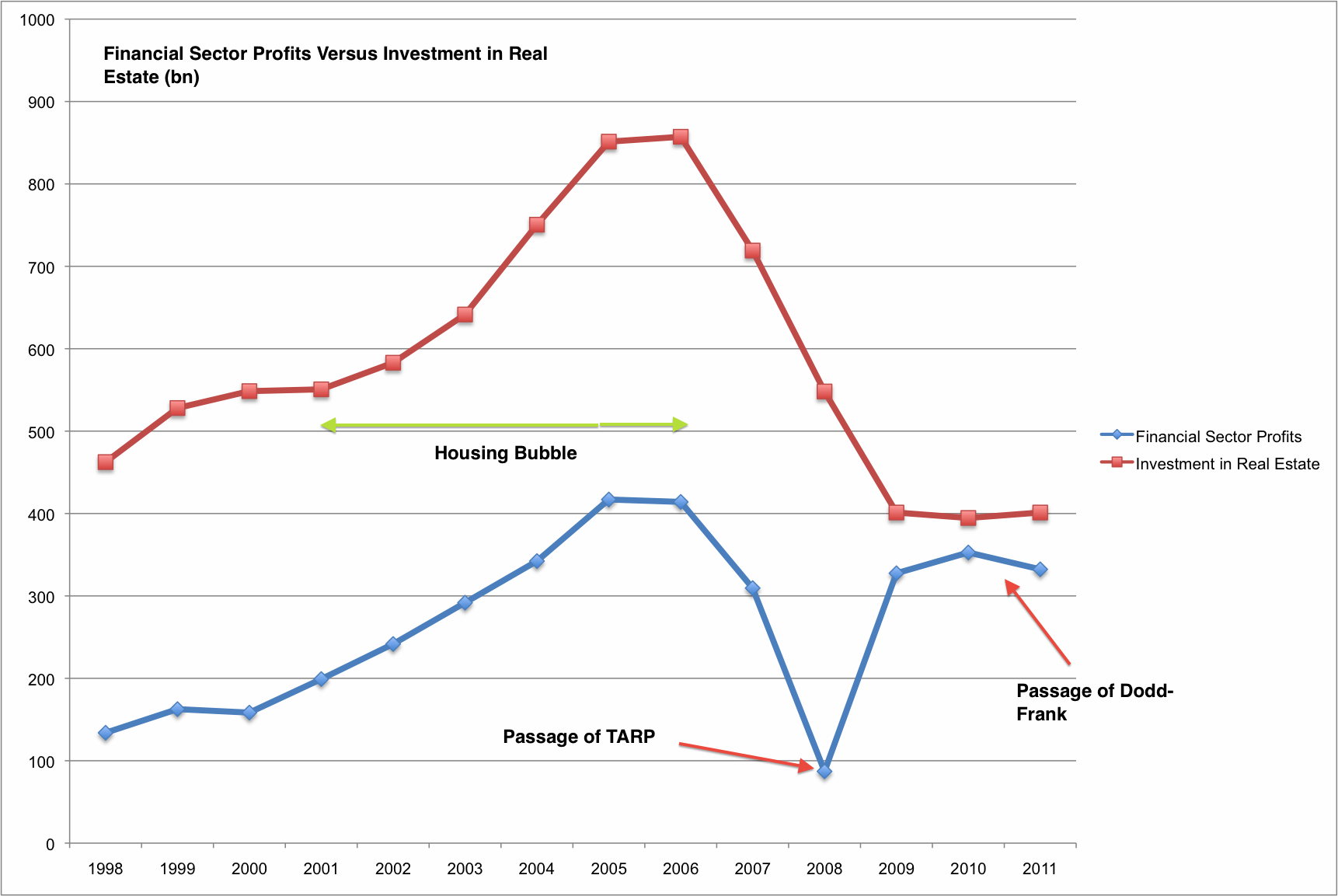

TARP (which is really shorthand for the bailouts, it means TARP and HERA, which is the bill that bailed out Fannie and Freddie, which was passed at roughly the same time) is correlated with a spike in financial profits. Dodd-Frank is correlated with… nothing.Stoller’s second analysis shows the strong correlation of financial services earnings with the housing bubble (click to enlarge):

This chart reveals that financial sector profits are actually still at 2004 bubble levels, and that the profit increases and declines are correlated with the bubble and TARP, not Dodd-Frank.

This is a major topic, and we’ll be returning to it, but there is one big takeaway: in trying to bolster the case for Obama, Democrats are unwittingly carrying the financial services industry’s water in blaming new regulations for their crappy profits, when the direct consequences of the crisis they created is far and away the biggest culprit.

The False Dodd Frank Narrative on Bank Profits (No, Honey, Obama Did Not Shrink the Banks) « naked capitalism

No comments:

Post a Comment

your feedback and opinions welcome.