Recessions are times when there is too little demand for the products of businesses, and so they fail to employ all those who want to work. That the problem in a period of high unemployment like the present one is a lack of business demand for employees not any lack of desire to work is all but self-evident. It is demonstrated by the observations that (i)the propensity of workers to quit jobs and the level of job openings are at near-record low levels; (ii) rises in nonemployment have taken place among essentially all demographic skill and education groups; and (iii) rising rates of profit and falling rates of wage growth suggest that it is employers, not workers, who have the power in almost every market.

-The jobs crisis, Larry Summers, Reuters

Here, here. I agree with Larry Summers that a shortfall in demand is creating a US jobs crisis. However, I don’t agree with the thrust of his blog post that there is any magic in the concept that a “lack of demand is the fundamental cause of economies producing below their potential”.

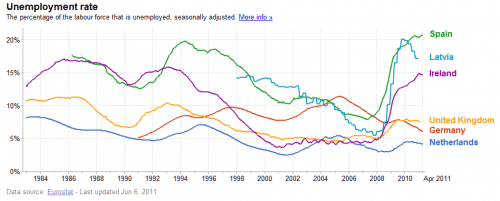

Take a look at this chart and tell me what you see?

Here’s what I see. I see two economies in the Netherlands and Germany where there was no housing bubble and unemployment had risen during the global recession but not by mind-bending amounts. Then I see four other economies wracked by massive housing bubbles in Ireland, Spain, the UK and Latvia where unemployment had skyrocketed.

Moreover, Britain has seen the most muted rise in unemployment amongst the bubble economies, presumably because it is a monetarily and fiscally sovereign nation that can use these tools to address shortfalls in demand and cushion the downturn.

Every single economy that has had a housing bubble has seen a massive rise in unemployment. That speaks to the destruction of credit bubbles. It’s not just about demand.

No comments:

Post a Comment

your feedback and opinions welcome.